Every product owner and designer in banking knows the pressure: customers expect seamless digital experiences, yet, inside the boardroom, UX often gets dismissed as “just interface design.” The result? Teams are left fighting uphill battles-begging for budgets, negotiating for resources and struggling to prove that user experience isn’t just a cosmetic upgrade but a business-critical strategy. Meanwhile, Fintechs and tech giants are redefining what “good banking” feels like, raising customer expectations with every tap and swipe. If banks don’t catch up, even their most loyal customers won’t wait around. The issue isn’t whether UX matters, but whether product teams can convince executives that investing in it today is the most important way to secure the bank’s future tomorrow.

It’s a wake-up call for product owners, digital project managers, and UX/UI designers in banks and financial institutions. You can—and must—move UX and digital branding to the center of strategy and weave them into the DNA of the business. Because if you don’t, you’re not just risking a bad app rating—you’re risking the future of your organization. UX is no longer a paint job; it’s where revenue either leaks—or compounds.

Inside most banks, UX dies by a thousand “just for now” decisions: a temporary flow patched to meet quarter-end targets, an extra field added to satisfy an audit trail, three teams “owning” the same journey, a vendor contract dictating the interface instead of the other way around. The result? Call centers absorb the cost, NPS slides, and executives wonder why acquisition is falling when “the feature shipped.”

And here’s the bigger truth: you may be the long-awaited hero to move things forward. The one who can turn empathy into economics, transform broken journeys into business metrics, and show executives that UX isn’t a cost—it’s the growth engine, the risk control, the cost-to-serve reducer. You hold the power to change everything before it’s too late.

This guide is your shield and spear. It arms you with the proof, language, and plays to secure executive sponsorship. Because in financial services, the app is the branch, the message is the brand, and the experience is the strategy. And with the right push from you, UX can finally take its rightful place at the heart of your organization’s future.

Strategic Role of Financial Product UX

Financial products are no longer competing on interest rates or branch locations—they’re competing on experience. In a market in which switching costs are low and expectations are set by the world’s best digital platforms, the real risk isn’t building too much UX; it’s ignoring it. Money moves faster than trust, and customers don’t judge a bank by its balance sheet—they judge it by the few seconds it takes to open an app, transfer funds or get clarity on their savings. If the experience feels clumsy, slow or confusing, they leave. Simple as that.

According to Deloitte, with 84% of customers using online banking and 72% using mobile apps as their primary channel, digital touchpoints are now the “front door” of the bank for most customers. This means that user experience (UX) and digital branding are not just design concerns; they are strategic imperatives in the modern financial industry. The truth is stark: in today’s world, your user experience is your brand. Ignore it, and you risk watching loyalty, relevance and revenue slip silently into the hands of competitors who simply made banking feel effortless.

In a world in which Fintechs and tech giants set the UX bar, traditional banks risk being left behind. In fact, 91% of consumers say a bank’s digital capabilities influence their choice of provider, as evidenced by Motley Fool Money's 2024 Digital Banking Trends and Consumer Priorities survey. I believe these numbers highlight a simple truth: for today’s banking customers, UX is the brand.

Conversely, a poor UX can erode even a centuries-old brand—if an app is confusing or unreliable, customers won’t hesitate to switch to a competitor or Fintech alternative. Sixty-two percent of banking customers worldwide would switch providers if they feel they were treated “like a number,” and 53% would switch if services feel impersonal according to a Saleforce survey of 9,500 FSI customers worldwide. Studies from PwC, Emplifi and Invoca all show that just one or two bad experiences can drive even loyal customers away. These figures underscore that personalized, user-centric design isn’t a luxury—it directly drives retention.

Critically, great UX isn’t just about avoiding customer loss; it creates positive business outcomes. Banks with the highest advocacy scores (top 20%) have grown their revenues 1.7x faster than those with the lowest scores, according to Accenture. A strong digital brand paired with excellent UX can become a growth engine, increasing usage of products, cross-selling more services and turning customers into advocates.

In essence, UX and digital branding have become strategic assets that align with core business goals—growing the customer base, deepening relationships and improving efficiency. According to TABInsights, the top 100 digital banks worldwide (e.g., Nubank, WeBank, Revolut, Mox, Ally) witnessed staggering financial momentum: between FY2021 and FY2023, they achieved a compound annual growth rate (CAGR) of 18% in revenue, along with robust gains in assets, deposits and loans. In the next sections, we’ll back these claims with up-to-date global data that will get executives listening.

Yet, many product teams struggle to convey this urgency within the executive suite. Executives may see digital initiatives as technical projects or marketing updates rather than as core drivers of business value. This guide is designed to help product owners and their teams translate the importance of digital branding and UX into the language of ROI, risk and growth that CEOs, CIOs, CMOs, CDOs and other leaders care about.

How to Get Executive Buy-In

Executives don’t wake up thinking about wireframes or user flows—they think about growth, costs and shareholder value. Speaking to them in the language of design will cause you to lose them whereas speaking to them in the language of ROI will result in a win

The hard truth: great UX dies in boardrooms, not design labs. If you can’t connect design decisions to revenue, retention and efficiency, executives won’t listen. To get buy-in, product owners must translate empathy into economics—and prove that experience isn’t just design, it’s strategy.

When executive buy-in is missing, digital service delivery in banks quickly fragments into a patchwork of “quick fixes” and underfunded initiatives. UX gets treated as surface polish instead of strategy, leaving core journeys weighed down by legacy systems, compliance-driven forms, and vendor templates that dictate design. Product teams fight for scraps of budget, projects stall in silos, and what launches often fails to deliver adoption.

The result is predictable: rising call center costs from confused customers, app store ratings that slide into irrelevance, NPS that erodes quarter by quarter, and churn masked as “channel preference.” Millions get poured into technology, but without leadership alignment, it never translates into customer trust, growth, or loyalty—only into missed opportunities and a widening gap with competitors who made UX their strategic priority.

Markets have priced in digital convenience; the spread now lies in perceived effort and empathy at scale. Boards that treat their digital product design as a capital allocation decision—and not merely a marketing expense—are already harvesting outsized growth, stickier deposits and superior margin dynamics. The numbers from the Big Four are conclusive: digital experience is the new basis-point engine. The question for every financial executive is no longer whether to invest in design, but how fast they can convert ROX (Return on Experience) into recurring shareholder value:

- Instrument ROX next to ROE: Pair traditional profitability KPIs with design-weighted metrics—time-to-resolution, digital first-contact success and emotional-sentiment scores. Audit them quarterly.

- Fund “experience debt” as aggressively as tech debt: Legacy UX flows erode price-premium capacity just as surely as outdated core systems threaten uptime.

- Make design a risk-management tool: A smoother journey reduces abandonment but also curtails fraud (fewer manual resets) and shrinks conduct risk via clearer disclosures.

The Missing Key

Most banks still treat UX and digital branding as side projects in marketing or IT—an afterthought rather than a strategic lever. This legacy mindset is dangerous. For decades, banking success was measured in balance sheets, branches and compliance, not in experience. But in today’s digital-first world, the customer journey is the business.

Yet, too often, UX is dismissed as a “design expense.” Without leadership sponsorship, initiatives remain underfunded, fragmented and unable to move the needle. The result? Millions spent on technology that never translates into customer trust, adoption or growth.

The evidence is overwhelming: consultancies from McKinsey to Bain show that banks leading in customer experience outperform laggards in growth and shareholder returns. Still, without board-level prioritization, banks end up with clunky digital products, inconsistent branding, rising churn and spiraling servicing costs as frustrated customers flood call centers or switch to challengers.

This is the silent crisis: banks that chase digital transformation while ignoring the one thing that makes it succeed—executive buy-in. Without it, they remain reactive, patching features to keep up rather than setting the pace. With it, UX and digital branding become engines of loyalty, efficiency and market leadership.

The future of banking won’t be won by those with the most branches or the lowest rates. It will be won by those whose leaders understand that customer experience isn’t a support function—it’s the core of growth, trust and survival. So, let's find out how to help your leaders.

Conversation Starters for Executive Buy-In

Sometimes the hardest part is getting the conversation started. Here are a few persuasive prompts and questions you can use in meetings with executives to spark interest and urgency about UX and digital branding:

- Have the Courage to Ask Provocative Questions: “What do you think happens when some of our customers would leave us for a better app? Do we know how close we are to that scenario?” This type of question forces reflection on potential pain. Or try: “Why is our digital NPS 30 when industry leaders are at 50+? What is that gap costing us in lost opportunities?” By posing questions, you invite the executive to explore the issue with you rather than feeling lectured, risking them to lose focus.

- Use “What If” Scenarios: “What if our mobile banking app rating went from 3 stars to 4.5 stars in the next year? Based on other banks’ experiences, that could mean more active users and a significant bump in deposit growth.” Painting a picture of a successful outcome helps executives visualize the win. Another example: “What if we could reduce account opening time from days to minutes? We might capture customers who currently abandon the process.”

- Leverage Empathy with Customer Stories: Share a short anecdote, such as: “I spoke with a customer who said she loves our products but almost switched banks because our app kept crashing during her mobile deposit. She felt we didn’t value her time. How many others feel the same?” Storytelling can be incredibly effective to make stats feel real. An executive who hears an authentic customer pain story will often remember it, and it can motivate them to support change. Nobody wants to be the cause of customer frustration.

- Cite Competitor Moves in Context: “As you know, Bank XYZ just launched a new AI-powered budgeting feature. Their CEO is touting that it doubled engagement among millennials. We have a plan to leapfrog that with our own personalized finance coach in-app. With your support, we could lead instead of follow.” Executives are competitive; framing our UX initiative as a way to beat the competition can energize them. It shows you’re keeping an eye on the market and have a response.

- Highlight Risk of Inaction: “Our analysts project that in 5 years, 3 out of 4 of our new customers will come through digital channels. If we don’t deliver a top-tier digital experience, those customers might never choose us to begin with. Can we afford not to invest in this?” Sometimes stating the risk bluntly makes the choice clear: invest in UX or face future decline. Executives are trained to mitigate risks, so make the UX gap a risk they feel responsible to address.

Each of these starters should be adapted to your style and the specific context of your bank. The key is to spark a dialogue rather than deliver a monologue. Encourage the executives to respond, ask what concerns them most about digital, and then show how a focus on UX and branding can alleviate those concerns.

Remember, your goal is to guide them to the conclusion that investing in UX is not only sensible but urgent. Support from the top will pave the way for the transformation initiatives, some of which we’ve touched on, like journey teams and quick-win pilots. Now, let’s reinforce the message by looking at real-world banking examples in which UX and digital branding made a tangible difference.

Tailoring the Message to the C-Suite

Different executives have different concerns, so a one-size-fits-all pitch might miss the mark. Here’s how to align the importance of UX and digital branding with the priorities of various leaders in a retail bank:

- CEO (Chief Executive Officer) / Board of Directors: Emphasize competitive advantage and growth. Explain that exceptional UX is key to winning market share in the digital era and fending off disruptive competitors. Highlight how a strong digital brand drives customer acquisition, loyalty, and lifetime value—all fueling top-line growth. Cite rivals or industry leaders using UX as a differentiator. For example: “Banks with the best customer experience enjoy significantly higher growth rates. By investing in our digital experience now, we can leapfrog competitors and position ourselves as a market leader in customer satisfaction.” CEOs also care about reputation. Note that a slick, customer-friendly app builds public trust and positive brand perception, which ultimately supports share price and strategic positioning.

- CIO / CTO (Chief Information Officer/Chief Technology Officer): Connect UX to the technology agenda and efficiency. The CIO’s focus is often on system modernization, security and reliability. Make the case about how good UX reduces complexity and technical debt. A clear UX strategy avoids the proliferation of disjointed platforms by using unified design systems and reusable components. This actually helps IT by providing a clear blueprint of what to build. Point out that a consistent UX across channels requires breaking silos (e.g. integrating mobile, web, CRM systems), which aligns with IT’s goal of a streamlined architecture. Also stress that fewer customer pain points mean fewer tech support issues: “An intuitive design means less strain on our IT support and call centers, freeing up resources for innovation.” The CIO will also respond to scalability and agility. Show that design thinking practices lead to faster prototyping and iterations, making the development cycle more efficient. In sum, pitch UX as a partner to IT that can drive adoption of the very systems the CIO is investing in.

- CMO (Chief Marketing Officer): Focus on brand consistency, customer engagement and analytics. For a CMO, the digital user experience is the living embodiment of the brand. Highlight that every interaction—from the app login screen to an error message—shapes the customer’s perception of the bank’s brand values. A seamless UX builds the kind of brand loyalty and emotional connection that advertising alone often can’t. You might say: “Our brand promise is ‘simple and trusted banking,’ but if our app frustrates users, that promise breaks. A consistent, user-centric design will reinforce our brand at every touchpoint, turning customers into brand advocates.” CMOs also appreciate data: note that digital channels provide rich customer behavior insights (e.g., clicks, drop-offs, feature usage) that can inform targeted marketing and personalization. A well-designed digital platform thus doubles as a powerful marketing tool. And remind the CMO that personalized UX drives marketing ROI. Personalized experiences can increase marketing efficiency by 10-30%, making their campaigns more effective.

- CDO (Chief Digital Officer) or Head of Digital Transformation: Align with their transformation mandate. The CDO is likely already on board with digital initiatives, but you can reinforce that UX design is the accelerator of digital transformation. Speak to the need for cultural change: “To truly transform, we need a customer-centric culture. UX workshops and design thinking sessions can engage our teams in that change.” For a CDO, highlight frameworks and systematic approaches—for example, how using design sprints or a UX roadmap can operationalize the digital strategy. Also point out that digital branding and UX strategy is about future-proofing: as the bank moves into new channels (e.g., wearables, voice assistants, etc.), a strong core UX ensures consistency and speed-to-market. Essentially, frame UX as the execution layer of the digital strategy the CDO is driving. Success for them means seeing tangible adoption and improved metrics, exactly what a great UX delivers (more logins, higher NPS, etc., all evidence of a successful transformation).

- CFO (Chief Financial Officer) and Risk Executives: Speak the language of ROI, cost savings and risk mitigation. The CFO might be skeptical of projects that don’t demonstrate clear financial benefits. Here’s where you can deploy ROI stats: reiterate the cost savings of digital self-service (for instance, remind them “each digital transaction saves us ~$3.90 compared to a branch transaction”) and the revenue uplift from happier customers (higher cross-sell and retention). Make it concrete and detailed: “If we improve our mobile app UX and increase usage by X%, we could potentially reduce call center volume by Y% and save $Z million annually, while also retaining more customers.” It’s also effective to frame not investing as a risk: the risk of customer churn and, hence, lost revenue if UX is poor, or the risk of falling behind competitors technologically, which could impact the bank’s long-term viability. CFOs also oversee risk and compliance: note that a well-designed user journey can guide customers to safer behaviors (e.g. clearer security prompts, reducing fraud incidents) and that customer trust, fostered by a reliable UX, is a bulwark against reputational risk.

By tailoring your messaging in this way, you ensure each executive hears “what’s in it for me and my department.” This multi-angle approach increases the likelihood of collective buy-in.

Digital Experience Moves Millions: Highlight ROX in Banking

Nothing captures executive attention like hard data. Here are key statistics and insights that demonstrate the ROX (Return on Experience): the strategic value of investing in UX and digital branding. Using data like this in discussions with executives will frame UX in terms of business KPIs they care about.

1. Customer Acquisition and Retention

When we look at the P&L of the world’s most customer-centric banks, one theme cuts through the noise: experience outperforms efficiency as a growth lever. KPMG’s latest Customer Experience Excellence benchmark shows that the UK’s top-10 CX leaders delivered 10× the revenue growth of their FTSE-100 peers, doubled average profit growth and enjoyed 89 percent retention with 75 percent fatter margins than laggards—while simultaneously cutting costs by up to 25 percent.

McKinsey research shows that successful experience-led growth strategies that increase customer satisfaction by at least 20 percent increase cross-sell rates by 15 to 25 percent, boost companies’ wallet share by 5 to 10 percent and increase cross-sell rates and engagement by 20 to 30 percent. In other words, better UX = more loyal customers who buy more products.

Loyalty translates to dollars: Bain & Co. found that Net Promoter Score (a key UX/CX metric) accounts for 20-60% of the variation in organic growth among banks. Loyal promoters drive meaningful revenue growth, validating that customer experience excellence translates to business expansion.

Conversely, lackluster digital UX actively drives customers away. Surveys show that 76% of consumers (up from 52% in 2020) would consider switching banks for better digital services and experiences, according to a Motley Fool survey of 2,000 consumers. In short, a poor mobile or online banking experience can send three-quarters of your customers looking for a new provider.

2. Digital Engagement and Market Reach

Major banks now serve tens of millions via digital channels. For example, Bank of America reports ~59 million verified digital users, and it spends $13 billion annually on technology. This staggering engagement shows how routine banking has moved to apps and websites at scale.Digital channels now eclipse physical branches in usage across all age groups and industries. Moneyzine report finds that 78% of Americans prefer digital banking, and only 29% of the US population prefers going to a branch. One reason is that consumers simply believe the service they get in person is better. In other words, a great digital brand experience lets a bank capitalize on where customers already are—online and on their phones—reaching and engaging millions daily at a relatively low cost.

Embracing digital UX expands a bank’s market footprint beyond branch networks. For instance, digital-only challenger banks have attracted millions of users globally via superior app experiences, forcing incumbents to improve their own UX. Banks that lead in mobile functionality consistently rank higher in customer growth. The takeaway: investing in a top-notch digital experience allows banks to meet customers where they are and extend services well beyond the branch footprint.

3. Revenue Growth from Digital Transformation

Research by McKinsey quantifies the payoff: banks that execute a successful digital transformation achieve a median increase of around 31% in revenue versus their baseline. This is a striking figure: roughly one-third more revenue is driven by digitization and the improved customer experiences it enables. UX is the customer-facing core of these transformations; it’s what turns new digital capabilities into actual customer adoption and sales.

Digital leaders often outpace competitors in acquiring new customers. By offering seamless digital onboarding and personalized online product offers, they convert more prospects. For example, banks that invested early in mobile banking saw their customer bases swell as consumers flocked to convenient digital options, especially during the pandemic years. Executives clearly see that better digital UX directly ties to winning more customers and earning more from each customer (through upsell/cross-sell), thus fueling faster revenue growth.

4. Cost Efficiency and ROI

According to Bain analysis, a typical mobile banking interaction incurs a variable cost of only about $0.10, versus roughly $4.00 for a teller or call-center transaction. That’s a 40× cost difference. Every routine task that shifts from a branch visit or phone call to a well-designed digital self-service channel yields enormous savings. For example, an address change or funds transfer done in-app costs pennies, whereas doing it with staff costs dollars. These savings at scale improve a bank’s cost-to-income ratio significantly.

A better UX also lowers “failure demand” costs. When customers struggle with a poorly designed interface, they end up calling support or visiting branches. A user-friendly design prevents those extra contacts. Fewer support calls and branch visits directly reduce operating expenses. In banking, simplifying online loan applications or mobile deposit flows similarly reduces help desk volume.

These efficiency gains do not come at the expense of customer satisfaction; in fact, they enhance it. Customers prefer fast, convenient self-service. Bain noted that mobile interactions not only cost less, but they have half the likelihood of annoying a customer compared with branch visits. The ROI of great UX is thus twofold: higher customer satisfaction and lower servicing costs.

For instance, a Bain study estimated that the largest US banks could save $11+ billion per year by shifting more customers to digital and reducing high-cost branch/call center interactions. Better UX makes banking easier, which saves money for the bank and time for the customer—a win-win.

5. Market Leadership and Shareholder Value

Design-led, customer-centric companies don’t just win awards; they also outperform financially, as evidenced by market share and stock performance. Banks are no exception. Customer experience leaders have dramatically outperformed laggards in stock returns over the long run.

Watermark Consulting’s analysis of Forrester’s Customer Experience Index finds that customer experience (CX) leaders enjoyed stock returns 5+ times higher than CX laggards over a 16-year period. Specifically, companies in the top 10 of CX rankings generated ~534% total return, vastly outperforming the ~98% total return of the bottom-tier companies. This huge gap underscores that investing in customer experience excellence yields real financial payoffs, while, conversely, poor experience erodes value. Banks with the highest customer satisfaction scores (often due to superior digital UX) have seen improved revenue growth and higher market cap gains than their less customer-centric rivals.

In banking, those that invested early in digital UX have reaped market-share rewards, while laggards have struggled. For example, Singapore’s DBS Bank undertook a top-to-bottom digital transformation starting in 2009. As a result, it boosted its mortgage lending market share from 24% to 31% and its credit card share from 19% to 25%, just within a few years. DBS went from being the lowest-rated local bank to winning “World’s Best Digital Bank” and saw its stock valuation multiple become the highest among its peers.

Similar stories are seen at Capital One, BBVA and others: banks that aggressively improved their mobile/apps and overall UX earned customer accolades and new business, whereas those slow to modernize have lost ground. The pattern is clear: UX and digital branding investments are not “soft” costs; they drive hard outcomes like higher growth, lower costs and stronger shareholder returns.

Case Studies: UX Success Stories

Seeing peers succeed can often convince executives more than any theory. Here are a few compelling examples from over 150 financial products designed by UXDA—banks around the world that reaped rewards by prioritizing UX and digital branding. These case studies illustrate what’s possible and provide proof that UX strategies work in business:

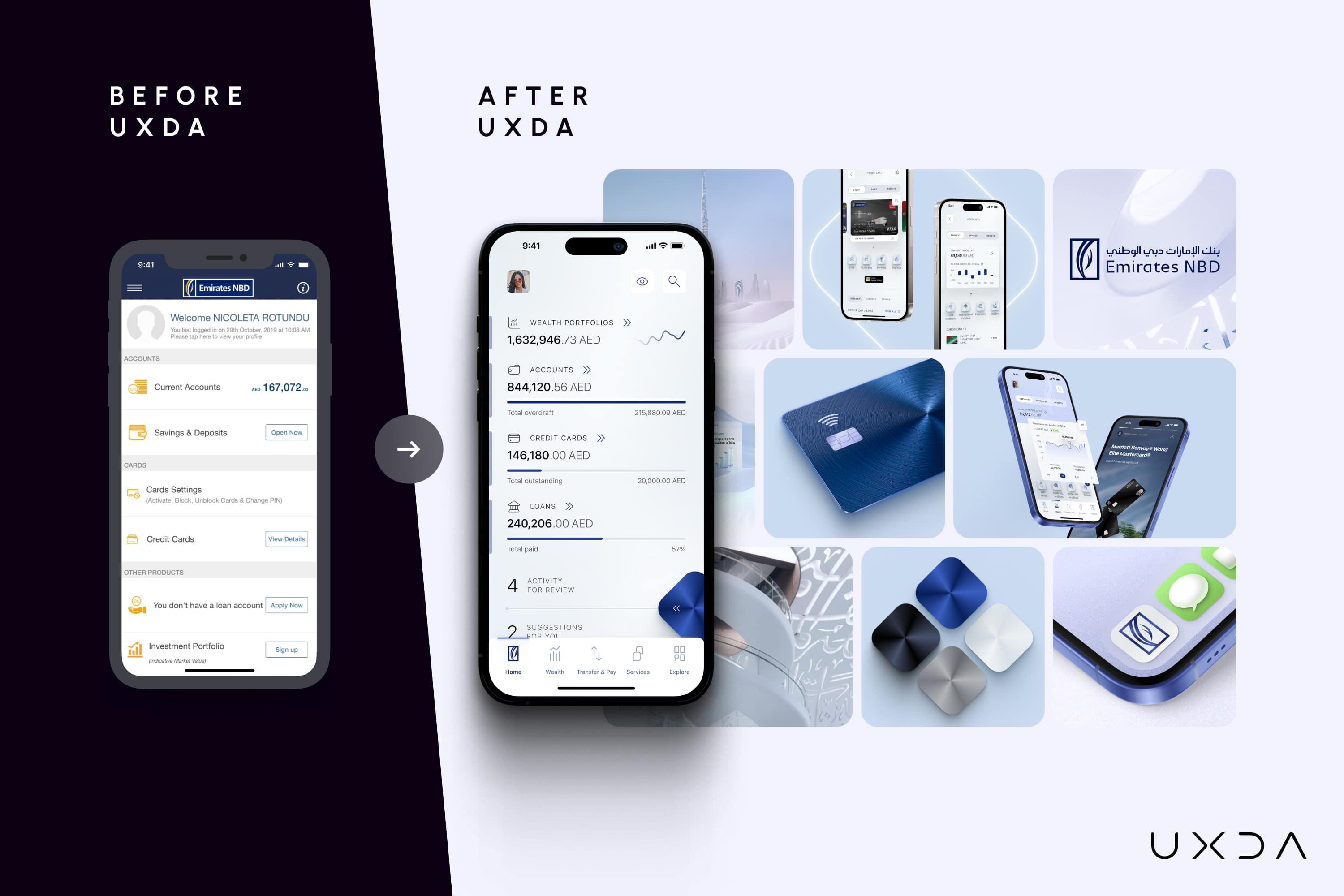

Emirates NBD (UAE)

Emirates NBD (ENBD), one of the largest banks in the Middle East, undertook a comprehensive UX-led digital transformation with the help of a UX framework aligning their brand and customer experience. The results were remarkable: after redesigning their digital ecosystem, ENBD achieved a 91% digital adoption rate on their new platform, saw a 50% surge in transaction activity and improved their mobile app store rating from a dismal 2.0 to 4.7 stars. Even more impressive, their wealth management client base grew 16× (1,600% increase), showing how a better digital experience can attract and retain high-value customers.

These changes earned ENBD recognition as the region’s top banking app in 2023. The case proves that a strong digital branding and UX strategy (in ENBD’s case, implementing UXDA’s “Digital Experience Branding” framework across the digital ecosystem) can directly drive adoption and business growth. When sharing this with executives, you might note: “ENBD didn’t get those results by accident— they treated UX as a strategic priority, aligning their mission, values and design across the whole user journey, and the payoff was huge.”

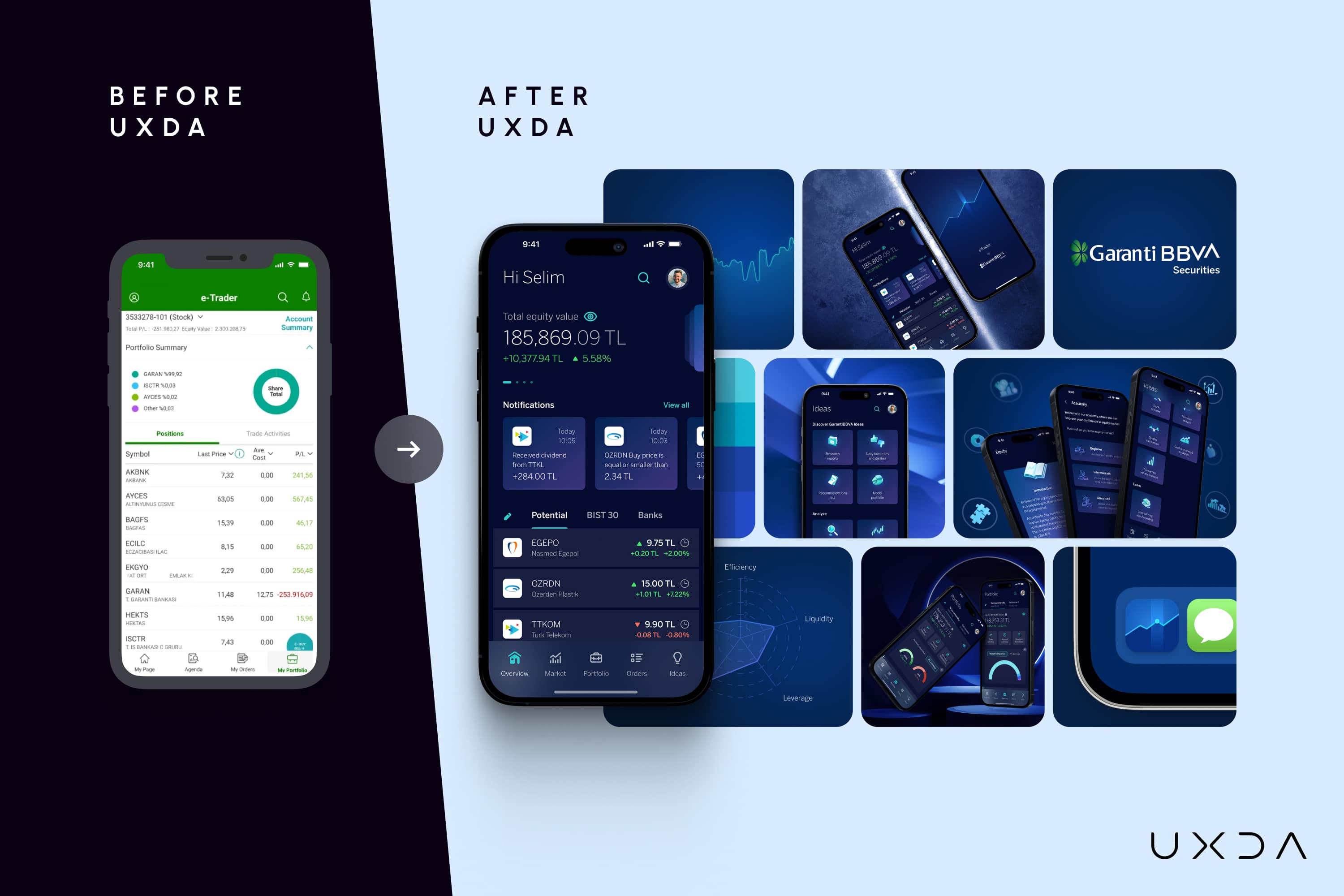

Garanti BBVA Securities (Turkey)

Garanti BBVA Securities wanted to transform its digital investing platform into a best-in-class experience. The challenge: most investment and trading apps overwhelm users with complex data and outdated interfaces. Through UX-led redesign, they created a simple yet functionally powerful platform that empowers investors with clarity, usability and confidence.

The new platform aligns with BBVA’s global vision and brand identity, positioning Garanti BBVA as an investment innovator in the Turkish market. For executives, this case is proof that even in specialized areas like trading and investments, UX can create the difference between confusing complexity and a world-class, trusted experience.

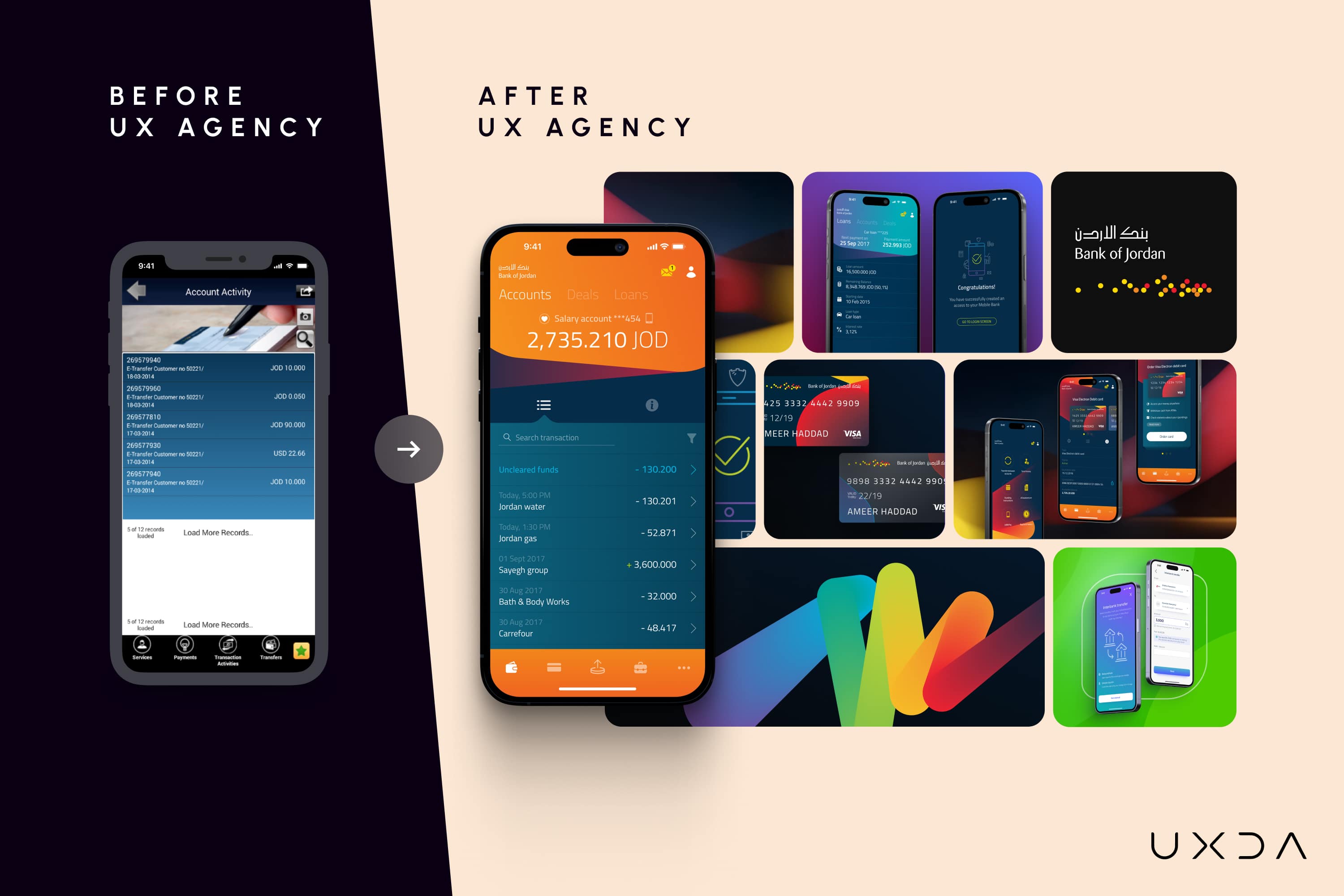

Bank of Jordan (Jordan)

Bank of Jordan (BoJ) serves as a great example of focusing on brand-driven design to fix a failing digital product. Their mobile banking app was struggling with a 2.8 star rating and loads of customer frustration due to complexity and poor usability. BoJ partnered with a UX agency to completely revamp the app’s UX, simplifying navigation and making the interface intuitive. In just six months post-redesign, the app’s Google Play rating jumped to 4.7 stars: a transformation from “hated” to “loved” by users. Customer satisfaction soared, usage increased, and previously angry customers became fans as everyday tasks, like checking balances or paying bills, became easy and even enjoyable.

This story is powerful for executives because it shows how fast UX improvements can change customer sentiment. One could say, “In half a year, BoJ turned a failing app into a customer favorite, simply by prioritizing user needs. Imagine what parts of our experience we could dramatically improve by our next quarterly results if we take a similar approach.” It’s a testament that course-correcting with UX can rescue and revitalize a digital channel, even mid-transformation.

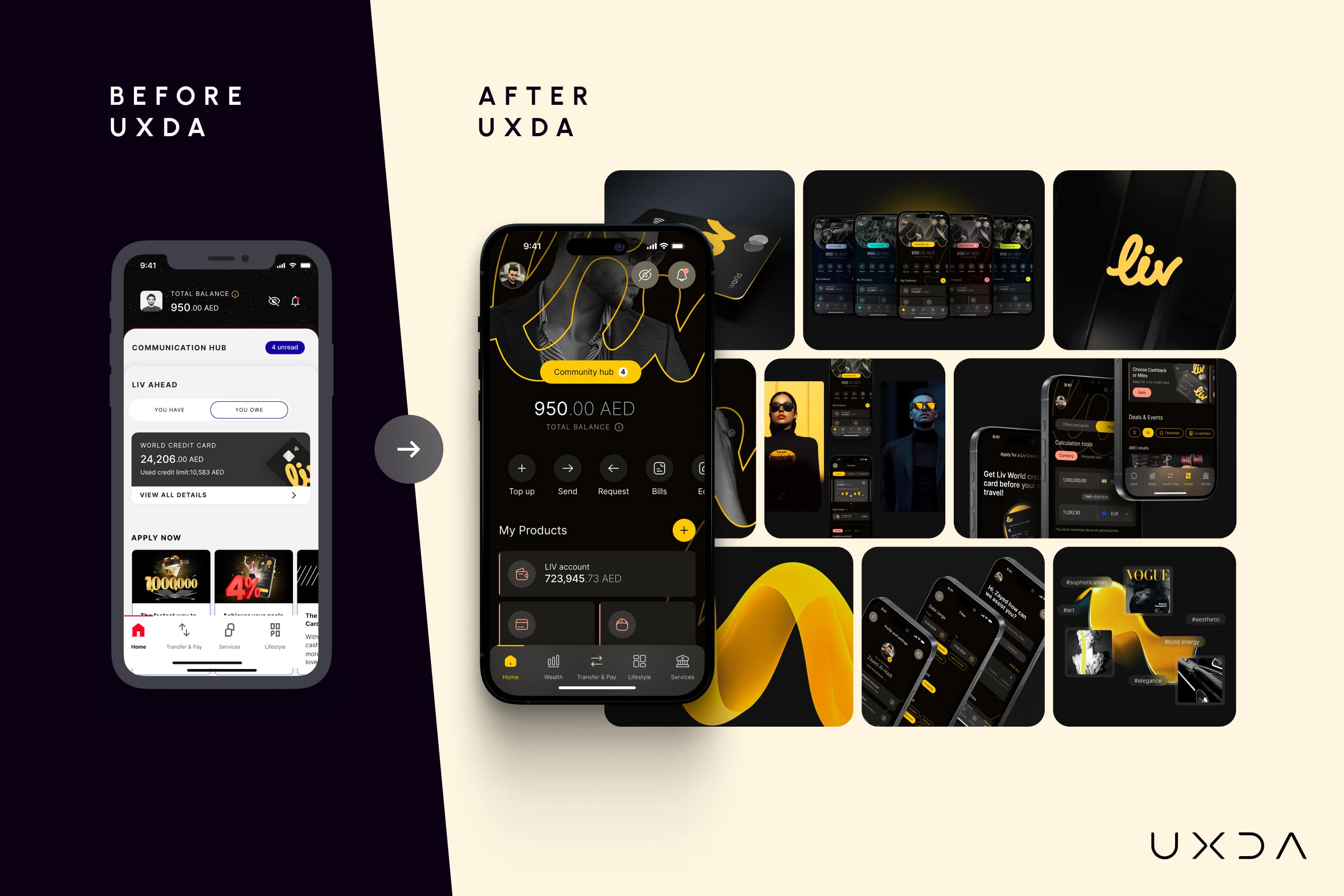

Liv Digital Bank (UAE)

Liv, the first digital-only bank in the UAE, was launched to target younger, lifestyle-focused customers. Instead of offering “just another mobile banking super app,” Liv positioned itself as a lifestyle companion—integrating payments, savings and even experiences like food deals and events into one platform. By building its digital identity around customer lifestyle needs rather than products, Liv became the fastest-growing digital bank in the Middle East, North Africa and Turkey (MENAT).

Within a short span, it amassed over 300,000 users and was ranked among the world’s top 100 challenger banks. The lesson for executives: when you design around lifestyles and emotions, not just financial tasks, digital banking can become a magnet for the next generation of customers.

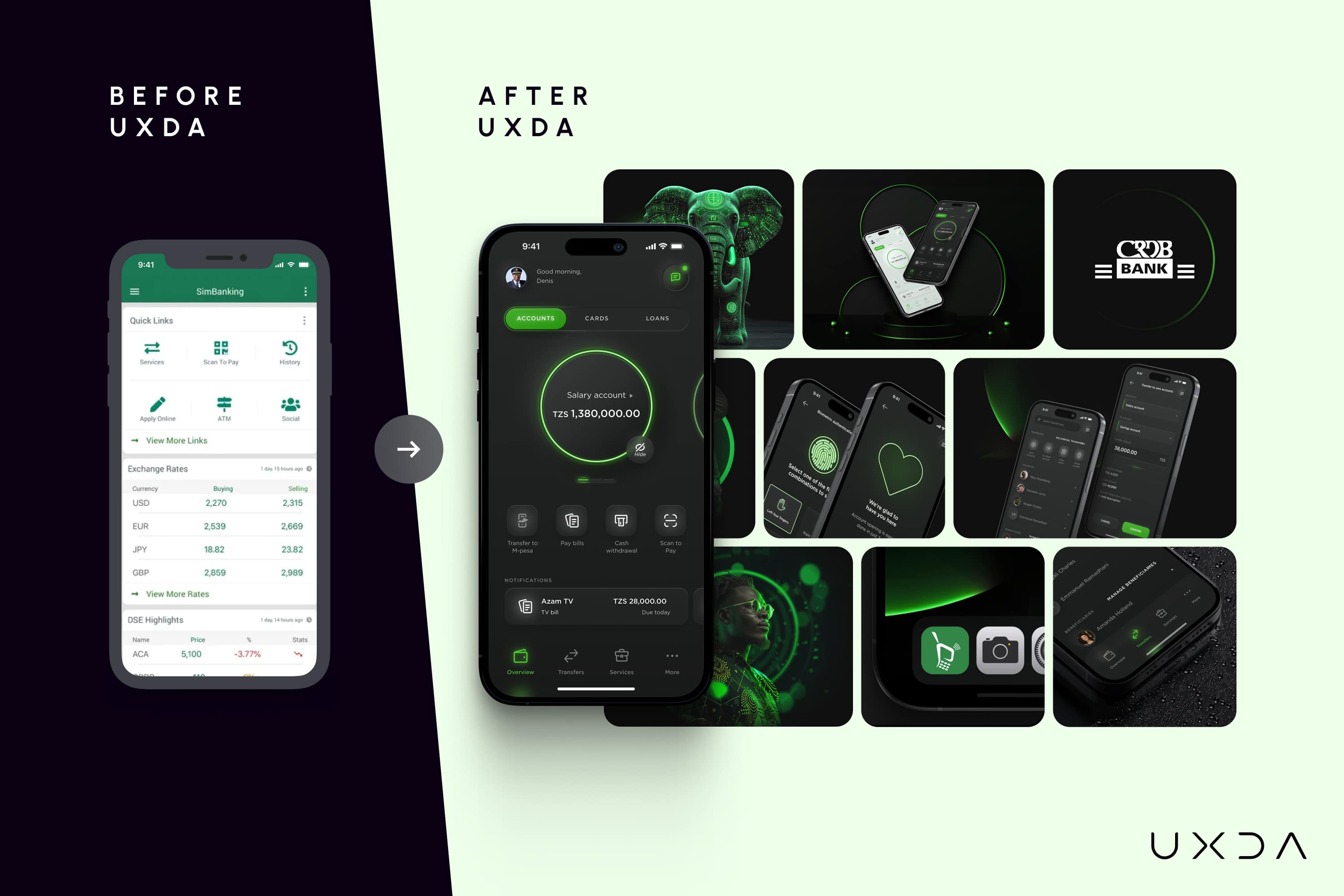

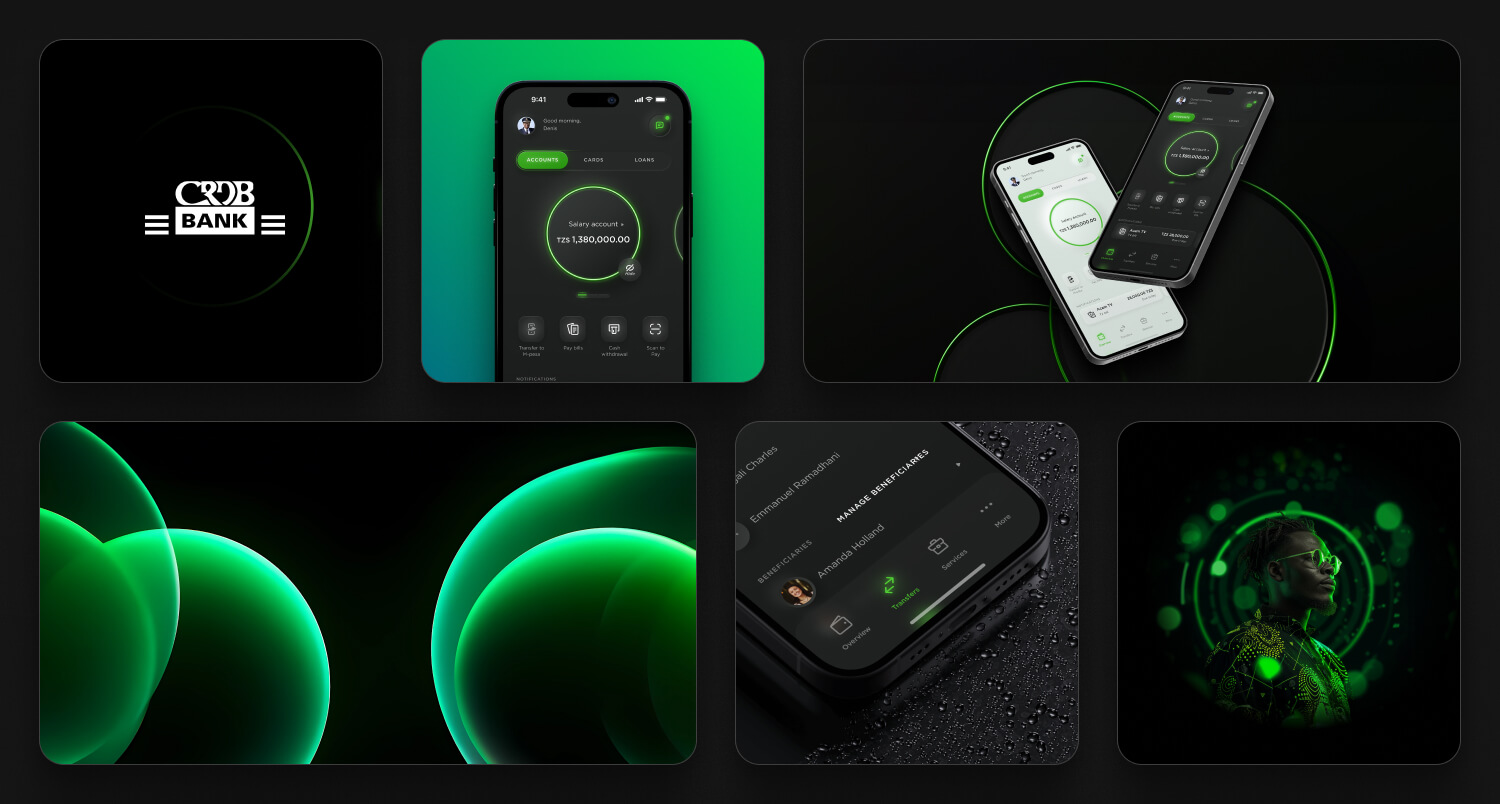

CRDB Bank (Tanzania)

CRDB, one of the largest banks in East Africa, realized its digital channels felt outdated and undifferentiated. Partnering with UXDA, they reimagined their mobile banking into a modern, intuitive and future-focused experience. The transformation moved CRDB from a “standard digital bank” to a leading brand that the region recognized as innovative and customer-centered.

By blending cultural nuances and cutting-edge design, CRDB now offers a digital experience on par with global leaders—setting a new benchmark in Africa. This story shows executives how even legacy institutions in emerging markets can leapfrog competitors through bold UX investment.

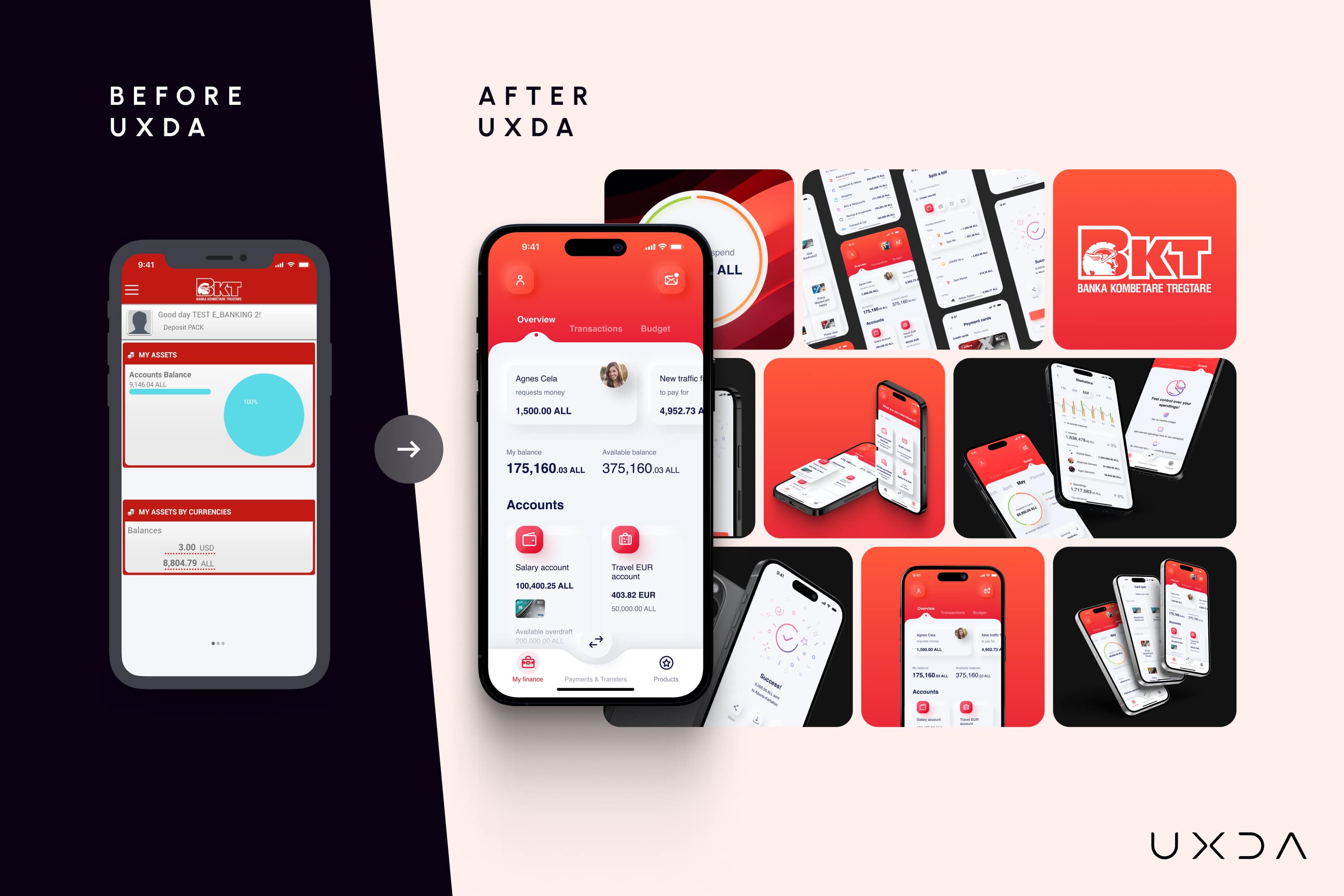

BKT Bank (Albania)

BKT, the largest bank in Albania with a century-old history, faced a challenge: their digital channels didn’t reflect the modern, customer-friendly brand image they sought. Users complained about clunky navigation and poor service integration. By redesigning the app with UX principles and a Dopamine Banking approach, BKT introduced a streamlined, intuitive digital experience that reestablished customer trust.

Everyday tasks became seamless, leading to increased adoption and positive customer feedback. For executives, the key takeaway here is that even well-established legacy banks can modernize their digital image and improve satisfaction quickly by focusing on UX.

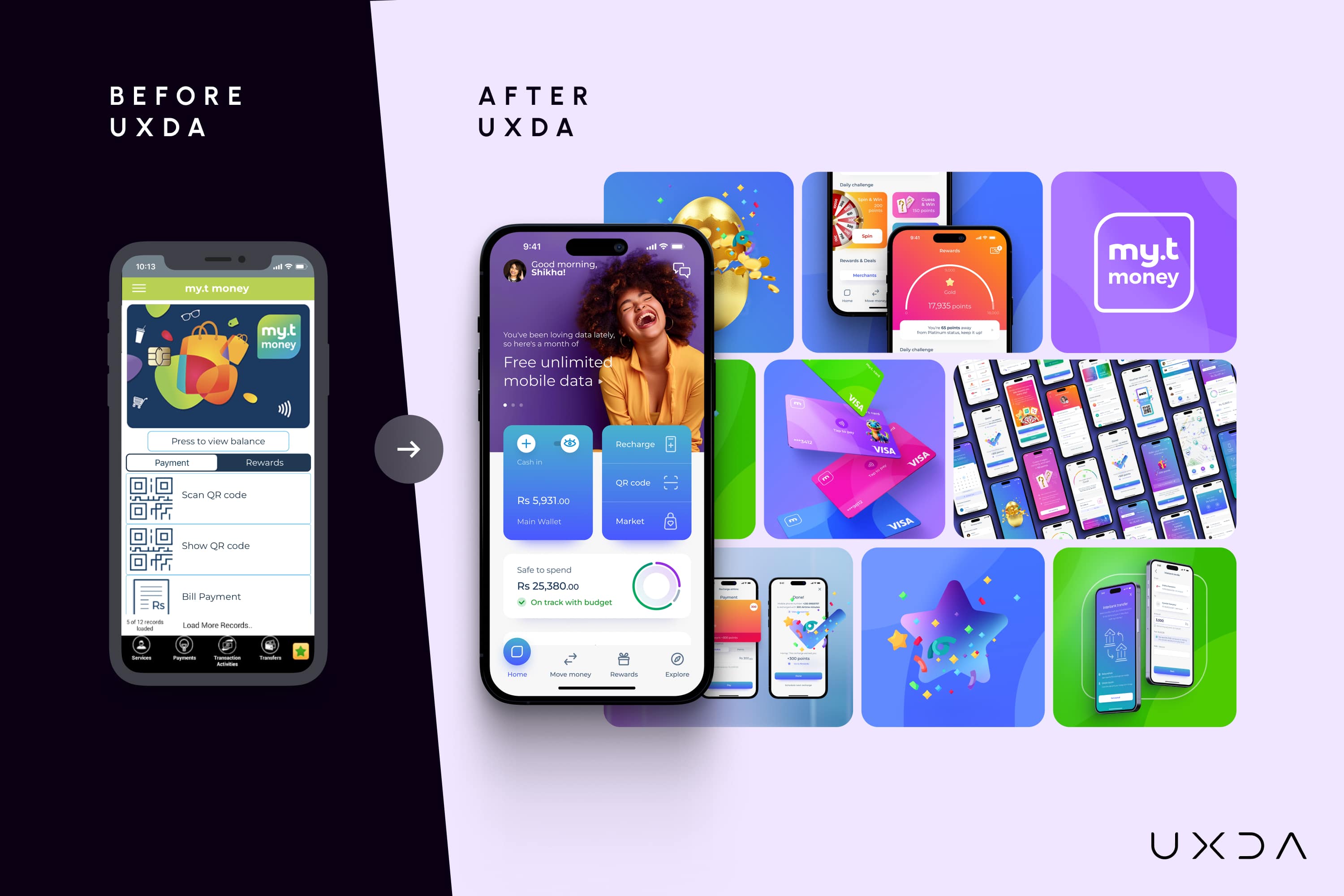

Mauritius Telecom Superapp (Mauritius)

In Mauritius, myt.money app by Mauritius Telecom set out to unify fragmented financial services into a single, modern “superapp.” The vision: move beyond offline and basic banking to create a holistic financial digital platform. Through strategic UX design, myt.money app offers seamless integration of payments, remittances, savings and lifestyle services—a digital leap forward for the region.

This innovation not only positions Mauritius Telecom as a digital pioneer but also shows how smaller markets can use UX to disrupt and lead. For executives, it demonstrates that “superapp thinking” isn’t limited to Asia’s giants. With the right UX strategy, any institution can consolidate value and win customer loyalty.

Each of these cases—whether a sweeping transformation or a targeted redesign—provides evidence that investing in UX and digital branding pays off. More importantly, they offer blueprints and inspiration. You can draw parallels to your own bank’s situation: maybe your app ratings aren’t as low as BoJ’s were, but there might be key pain points to address. Or maybe you’re not as far along as DBS, but you can start forming journey teams. Use these stories to instill confidence that “if they can do it, we can, too.”

UX Transformation Strategy

Transformation isn’t about new tech or bigger budgets—it’s about reimagining the way people experience money. A true UX transformation doesn’t add features; it rewrites the relationship between a bank and its customers.

Without a clear UX strategy, transformation is just noise—new tools layered on old thinking. The winners will be those who use UX as their compass, aligning every digital touchpoint with human needs. Anything less is just modernization, not transformation.

Accelerate Digital Transformation with UX

Securing executive agreement is just the first step. The next challenge is to initiate and accelerate digital transformation in-house using UX and digital branding as catalysts. Here are practical strategies design teams can use to get things moving quickly:

1. Start with a User-Centered Business Case

Build a compelling business case that links UX improvements to business outcomes. Use the stats above to quantify potential benefits. For example, calculate how a 5-point increase in app store rating or NPS could translate into revenue based on retention correlations. Present a before and after scenario: “Our mobile app’s conversion rate for loan applications is only 10%. With a better UX (industry leaders hit ~20%+), we stand to double our digital loan sales.” By framing improvements in terms of dollars, percentages and benchmarks, you offer executives a clear ROI rationale. Tip: include real customer quotes or app store reviews to humanize the pain points. A short, frustrated customer comment about your digital service can poignantly underscore the need for change.

2. Demonstrate Quick Wins through Prototypes or Pilots

Executives often respond to tangible results. Identify a high-impact, low-effort area of the digital experience to improve first—something like the online account opening flow or the frequently used mobile transfer feature that customers complain about. Run a design sprint or a UX audit on this area and implement a pilot redesign. For instance, UXDA’s work with Emirates NBD app simplified a convoluted interface and raised its rating from 2.0 to 4.7 stars in six months. Even if you can’t deploy changes to all users immediately, create an interactive prototype or A/B test to demonstrate the improved experience. When executives can see and touch a solution—not just hear theory—it builds confidence. Share any early metrics from a pilot (e.g. “in our test, 30% more users completed the task successfully”) to demonstrate the value. These quick wins create momentum and show that the team can execute effectively.

3. Benchmark Against Competitors and Fintechs

Nothing spurs action in a bank quite like the fear of being outdone by competitors. Do a bit of research on peer banks or popular Fintech apps and benchmark UX features. For example, maybe a competitor’s app allows account opening in 5 minutes and ours takes 15, or their personal finance dashboard is earning praise from customers. Present these findings to executives: “Bank X revamped their digital onboarding last year and saw a spike in new accounts. If they continue to pull ahead in digital NPS, we could lose affluent millennials to them.” Back it with industry awards or ratings (e.g., JD Power or App store ratings) in which competitors rank higher. This comparative approach taps into executive competitive spirit and provides concrete targets for your own UX improvements (“We need to match or exceed Bank X’s capabilities by next year”). It frames the UX investment as not just nice to have but necessary to stay in the game and remain competitive.

4. Connect UX Metrics to Core KPIs

Ensure that the organization tracks and values the right metrics (we’ll detail specific KPIs in a later section). For strategy, start talking about customer-centric metrics in the same breath as traditional finance metrics. For example, in strategy meetings, bring up customer satisfaction scores, task completion rates and digital adoption percentages as KPIs, alongside revenue and efficiency ratios. Explain how these UX metrics are leading indicators for the lagging financial metrics. One tactic is to incorporate UX goals into the official company KPIs or OKRs for the transformation program. If the CEO sees “Increase mobile NPS by 10 points” on the corporate scorecard next to “Reduce cost-to-income by 2%,” it legitimizes UX work as part of the strategic plan. Also, make sure to visualize progress in executive updates: show before and after charts of drop-off rates or heatmaps of improved user flows to make the impact vivid.

5. Build Cross-Functional Collaboration and Ownership

Digital transformation cannot succeed in a silo. Use UX initiatives as a way to break down organizational silos. For instance, form a cross-departmental “Journey Team” for a critical customer journey (e.g., payments, onboarding, mortgage application, etc.) with reps from IT, operations, risk, marketing and a UX lead. This is exactly how DBS Bank approached transformation: they created journey teams led jointly by business and tech leaders to tackle customer pain points like account openings. Encourage an executive sponsor for each major journey or UX project. When a senior leader is directly involved in a design workshop or sprint, they become a champion for the outcome. Educate the broader team on design thinking (e.g., run a one-day design thinking workshop for managers) so everyone speaks the same language of empathy, ideation and experimentation. By embedding UX into cross-functional teams, you not only speed up execution (no more turf wars; everyone is aligned on the end-user goal), but you also create internal evangelists who keep the momentum going.

These strategies are actionable ways to turn executive buy-in into real progress. They demonstrate that improving UX is not just a vague concept but a disciplined process that yields quick results and aligns with the bank’s strategic objectives. In implementing them, communication is key, and that includes how you start the conversation with your executives. Let’s look at some effective conversation starters next.

Frameworks and Principles

Having executive support and inspiring examples is crucial, but you also need a methodology to effectively execute UX-driven transformation. This is where established frameworks and design principles come in. Banks should not approach digital UX in an ad-hoc way; instead, leverage proven approaches (such as those advocated by UXDA and design thinking leaders) to systematically drive change:

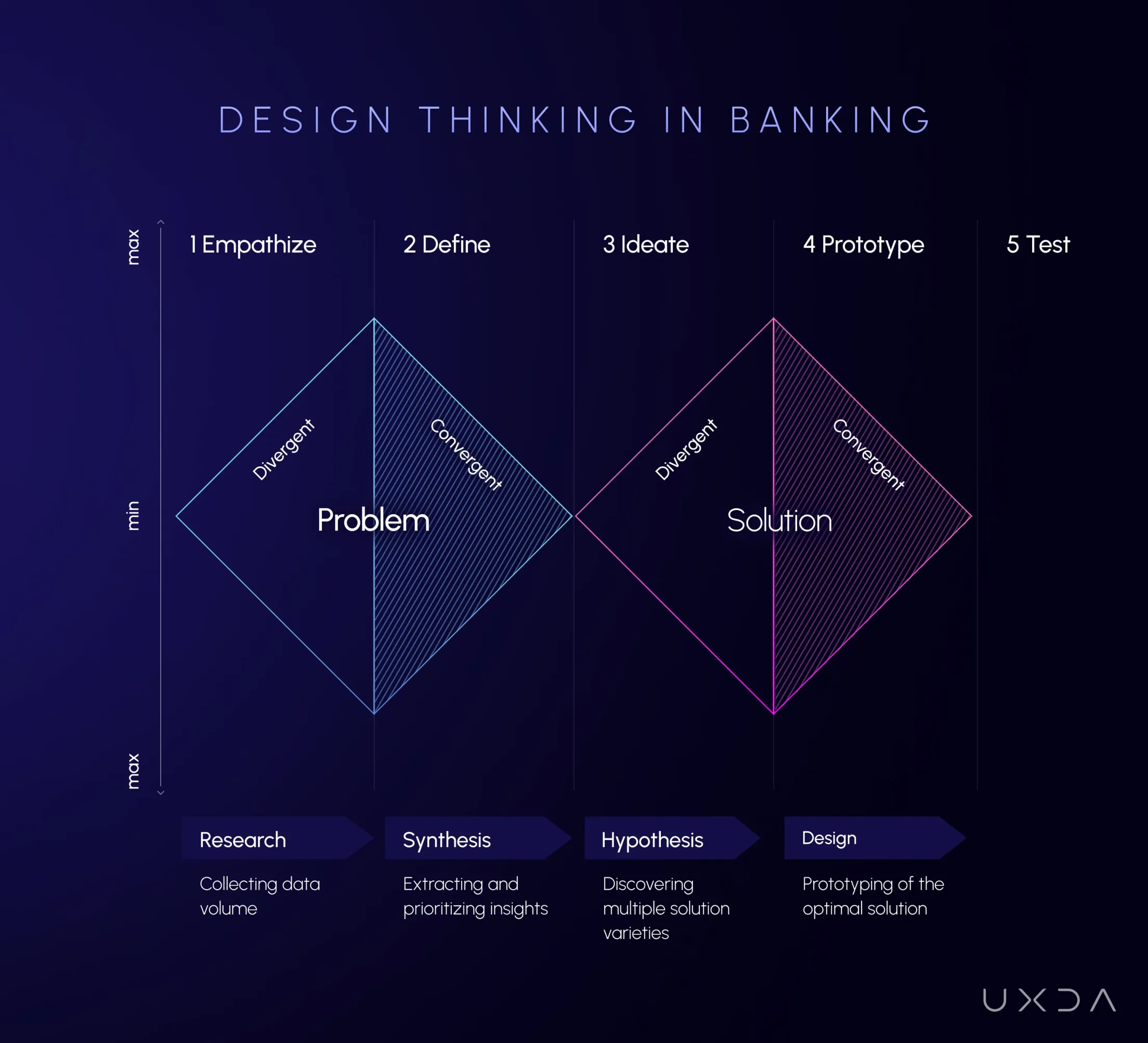

1. Design Thinking Methodology

At the core, embrace design thinking as your process for problem-solving. Design thinking provides a structured, iterative approach (one that Google and Apple use), and that UXDA integrates in our workflow. It consists of five key stages: Empathize, Define, Ideate, Prototype, Test. When designing award-winning banking apps, we added the Double Diamond framework to it to deepen understanding and narrow down the workflow.

Encourage your teams to start by empathizing with users through interviews, observations, and journey mapping to truly understand customer pain points and needs. Then define the core problems to solve, ideate multiple solutions (brainstorm freely across departments), prototype the most promising ideas (inexpensive, quick models of new interfaces or processes), and test them with real users to gather feedback.

Emphasize to executives that this is a repeatable, low-risk approach: instead of betting big on unproven ideas, design thinking cycles through ideas quickly and validates them, ensuring that final investments are grounded in user insight. Many banks have started running design sprints (a one-week condensed version of design thinking) to tackle specific challenges. This could be a great way to introduce the approach in-house.

Find more: How To Implement Design Thinking In Banking

2. Jobs-To-Be-Done and Customer Journey Frameworks

When guiding project teams, incorporate specific UX frameworks like Jobs-To-Be-Done (JTBD) and Customer Journey Mapping to maintain focus. JTBD, for instance, asks “What is the underlying goal a customer is trying to accomplish?” This helped one bank realize that customers didn’t want a mortgage per se; they wanted “to secure a home for my family.” This subtle shift led to more empathetic content and tools in their app (like a home-buying readiness quiz). UXDA experts note that frameworks like JTBD and Red Route Analysis (identifying the most critical user paths in an app) are valuable in pinpointing true user motives and the essential tasks that must be optimized.

By adopting these, your team can prioritize features that matter most to users’ primary goals, ensuring development resources are spent where it counts. Share with the CIO and CDO that using JTBD, journey maps, etc., helps avoid over-engineering features that customers don’t need, which results in more efficient use of IT budget and faster time-to-market.

Find more: From Friction to Flow: Enhancing Customer Journey in Banking

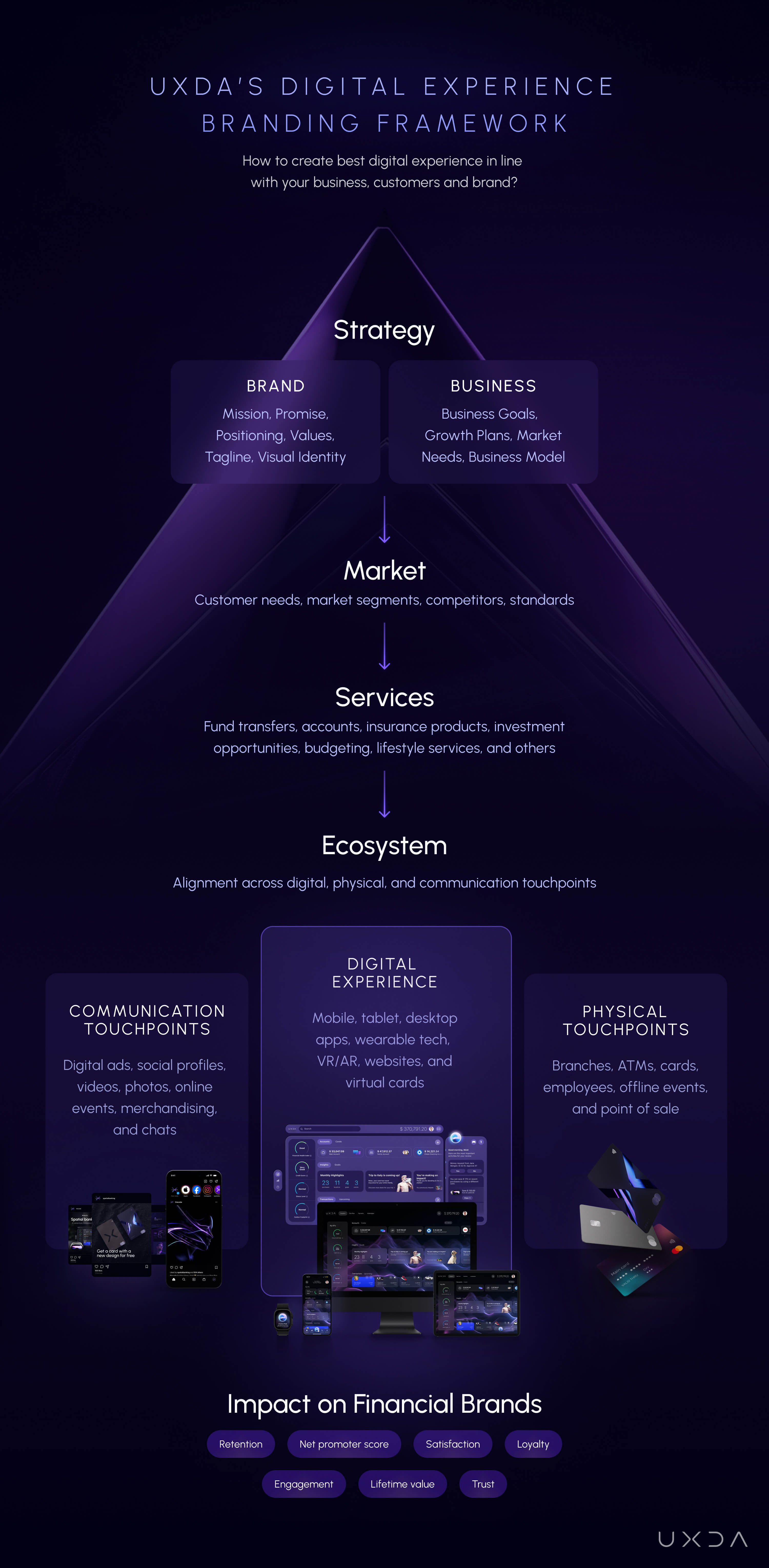

3. UXDA’s Digital Experience Branding Framework

To specifically connect brand strategy with UX, consider a framework like UXDA’s Digital Experience Branding model. This framework is essentially a step-by-step roadmap for embedding brand identity into every layer of the digital experience. It starts by clarifying the brand mission and values, then goes through understanding the market and customer segments, designing services as expressions of the brand and finally aligning all channels (e.g., mobile, web, social, even branch interfaces) into one cohesive experience. The beauty of this approach for executives is that it marries marketing strategy with UX execution.

For example, if your brand value is “transparency,” this framework makes sure that it translates into simple language in app prompts, easy-to-find fee information and consistent messaging across touchpoints—not just a slogan on a billboard. Emirates NBD’s earlier success was credited in part to applying this exact framework, integrating their brand values with product design, which ensured consistency and emotional resonance across their new digital ecosystem.

By referencing such a framework, you provide assurance that there’s a method to the madness—a structured approach rather than creative chaos. It’s a sign that the UX initiative will be managed with the same rigor as, say, a Six Sigma process improvement (an analogy some ops-minded execs might appreciate).

Find more: UXDA's Framework for Building a Strong Financial Brand in the Digital Age

4. UXDA’s Dopamine Banking Approach

To truly differentiate in an overcrowded market, banks must go beyond functionality and utility. UXDA’s Dopamine Banking approach provides a neuroscience-based framework for designing financial experiences that trigger positive emotions and long-term engagement. This framework focuses on creating digital journeys that activate the brain’s reward system through clarity, progress, personalization and delight. Instead of making banking a chore, Dopamine Banking transforms it into a motivational and rewarding part of people’s lives.

For executives, the value lies in customer loyalty: users who feel rewarded by their banking app will return more often, recommend it to others and deepen their financial relationship with the brand. In practice, this means designing flows that celebrate savings milestones, simplify complex tasks to reduce stress and personalize insights so customers feel understood. It reframes banking from being about transactions to being about emotional impact.

Find more: The Rise of “Dopamine Banking”: How Fintechs and Neobanks Are Redefining the Customer Experience

5. Continuous Improvement and Agile UX

Finally, pair these frameworks with an agile implementation mindset. Advocate for iterative releases and continuous UX improvement rather than a one-time “big bang” launch. This means setting up feedback loops (e.g., in-app surveys, usability testing sessions every month, feedback research) to continually gather data and refine the experience.

Executives will like to hear that we’re not betting the farm on untested designs; instead, we’re de-risking through small, frequent enhancements. It aligns with modern Agile/DevOps practices that many CIOs are already pushing for. Make the case that design doesn’t slow things down. When done in tandem with agile development, design sprints can actually speed up alignment and reduce rework by catching issues early.

Find more: Digital Transformation in Banking is an Illusion: Banking Innovation Will Never Stop

By grounding your transformation efforts in these frameworks and principles, you give everyone a common game plan. It demonstrates professionalism and foresight. You’re not just talking about ideas; you’re implementing with best practices. You might even invite an executive or two to sit in on a design thinking workshop or a journey mapping session. Once they see the structured creativity and user insights firsthand, they often become even stronger advocates.

With frameworks in place, the last piece of the puzzle is measuring success. – Let’s discuss the key metrics to track and report as you roll out UX improvements.

Key Metrics (KPIs)

To gain and maintain executive buy-in, you need to measure the impact of UX and digital branding efforts. Establishing clear KPIs not only proves success but also helps guide decisions. Here are essential metrics and how they tie back to business value:

- Customer Satisfaction and Loyalty Metrics: Net Promoter Score (NPS) and Customer Satisfaction (CSAT) are critical indicators of how users feel about the digital experience. An improving NPS over time signals that your UX efforts are resonating. This matters because higher NPS correlates with growth: Bain’s research found that a ~7 point NPS increase can translate to 1% revenue growth. Track NPS specifically for digital channels, if possible (e.g., an NPS question after an online session). Also monitor Customer Effort Score (CES) for key tasks, as easier experiences drive loyalty. Share these scores regularly with execs and tie them to hard outcomes (e.g., “Our mobile NPS improved 10 points after the redesign, and concurrently we saw a 5% uptick in retention of mobile-active customers.”).

- Digital Adoption and Usage: Measure what percentage of your customers are actively using digital channels versus branch or call centers. Also track the growth in digital transaction volume. One straightforward KPI is digital active users (e.g., logged in at least X times a month). Executive teams often set targets like “80% of transactions via digital.” For instance, after its UX overhaul, Emirates NBD hit a 91% digital channel adoption rate on key services, a powerful proof point. Showing increasing digital adoption not only validates UX improvements (customers vote with their feet) but also implies cost savings (more self-service). Segment adoption by demographics or product to spot areas to focus on (e.g., maybe adoption is low for wealth management clients, indicating an opportunity, as ENBD did which led to a 1600% increase in wealthy client digital usage after improving UX theuxda.com).

- Customer Retention and Churn: Attrition rate (or its inverse, retention rate) is a bottom-line metric that UX can influence. If possible, compute retention specifically among customers who engage with digital vs. those who don’t. Often, engaged digital users have higher retention. You can set a KPI like “increase retention of digitally engaged customers from 88% to 92%.” Small percentage changes here mean big revenue savings, as the cost of losing customers is high. Also track active customer churn during key digital interactions (e.g., how many start opening an account but never fund it?). By improving those journeys, you should see decreased churn in those micro-moments. Present to execs: “Our account opening completion rate went from 60% to 80%, which we estimate will add 5,000 more new customers this year.” That links UX directly to customer growth.

- Cross-Sell and Product Uptake: One of the promises of great digital UX is that it increases engagement and trust, leading customers to use more products. To gauge this, track metrics like products per customer (especially for those using digital channels) or conversion rates for cross-sell offers in digital (e.g., how many people who use the app for checking subsequently open a savings or credit card). If your app or site has personalized recommendations, measure the click-through and adoption of those recommended products; an improved UX in how you present and time these can significantly boost uptake. If you roll out a new feature (e.g., a personal finance tool), measure how it increases engagement with other services (like investments or loans). Executives will love seeing a clear uptick in sales attributed to a new UX feature.

- App Store Ratings and Reviews: While somewhat qualitative, app store ratings (for mobile) or online reviews are very public barometers of your digital brand health. They are an easy KPI for everyone to grasp. Set a target to reach and maintain a high rating (e.g., 4.5★). As you implement UX enhancements, monitor the trend in ratings and the sentiment in reviews. A jump from 3.5 to 4.2 stars over a few release cycles, for instance, can be directly attributed to fixing UX pain points. Share representative before/after review snippets with leadership, e.g., “Customers now describe our app as ‘simple and convenient’ whereas six months ago ‘frustrating’ was a common description. Our rating reflects this improvement.” This not only provides evidence of success but also boosts confidence in the brand.

- Task Success and Performance Metrics: Dive deeper into specific user journey metrics. For important tasks (e.g., online account opening, loan application, fund transfer, bill pay), track completion rate, time on task and error/try-again rates. Improvement in these tasks indicates a smoother UX. For example, “After the redesign, 85% of users can complete a funds transfer in under 1 minute, up from 60% before.” If you integrate customer support, track contact rate: did reducing friction in the design cut down how many people call for help on that process? One can quantify savings like “20% fewer support calls after we streamlined the login reset flow.” These granular metrics show the operational impact of UX. They’re great for the CIO and COO to appreciate efficiency gains.

- Operational Efficiency and Cost Metrics: From a financial perspective, monitor cost-to-serve per customer. As digital usage increases and if UX is effective, this should drop. Track things like number of transactions per employee (should rise with more self-service) or branch transaction volumes (should fall as digital picks up). Estimate how much money each percentage point of channel shift saves. For instance, “We moved 10% of transaction volume from branch to app this year; with ~50 million transactions, that saves roughly $X million, while also freeing up branch staff for advisory roles.” Also measure development efficiency: if you adopt design systems, perhaps track how much faster screens can be built or changed (e.g., “UI library reuse saved 30% of developer time for new features”). This shows that UX investment in design ops has productivity ROI.

- Brand and Engagement Metrics: Don’t forget higher-level brand metrics the CMO will care about. Brand awareness and brand perception surveys can include dimensions for digital experience (“is Bank ABC seen as a digital leader?”). Ideally, over time, improvements in UX should lift those scores. Also look at user engagement metrics like monthly active users, session frequency and duration—deeper engagement often correlates with greater wallet share. If you launch a new digital feature, track the number of adoptions (e.g., number of users setting up budgets in a budgeting tool). These show how successfully you’re capturing customer attention and fulfilling needs.

When reporting to executives, tie these KPIs back to the broader goals. For example, you might present a dashboard quarterly: Customer Satisfaction: NPS = 60 (up from 50, target 65), Digital Adoption: 70% of customers active digitally (up from 60%), Retention: 95% 12-month retention for digital customers (vs. 90% for non-digital), App Rating: 4.6★ (was 4.2★), etc., and add brief notes on what initiatives drove changes. By doing so, you make the impact of UX tangible and impossible to ignore. It turns design into a numbers-backed discipline in the eyes of the executive team, which is exactly how you secure ongoing support and funding.

Experience Drives Growth: From Buy-In to Lasting Change

Midway through a digital transformation, a retail bank’s leadership might feel uncertainty: “are we focusing on the right things?” This guide has equipped you and your UX/digital team to confidently answer “Yes, and here’s why.” By communicating the importance of digital branding and UX in a structured, compelling way, you can align executives around a shared vision of a customer-centric, digitally fluent bank.

To recap, you’ve framed UX as a strategic investment with clear ROI, backed by global stats and success stories. You’ve tailored the message to each executive stakeholder, speaking their language about how UX will help achieve their objectives—whether it’s growth, efficiency, innovation or risk mitigation. You’ve outlined practical strategies and conversation starters, moving the discussion from why to how to accelerate the transformation with UX as the engine.

Real-world case studies have demonstrated that this isn’t speculative; it’s already happening and yielding results in leading banks. You’ve also introduced proven frameworks (e.g., design thinking and UXDA’s methodologies) that will guide the bank’s teams in executing this vision systematically. And, most importantly, you’ve set forth KPIs that will track progress, ensuring accountability and ongoing executive confidence.

In redefining success around Return on Experience, financial institutions embrace a future in which people—their emotions, behaviors and aspirations—are the true currency. RoX reframes digital banking from a technical delivery to an ongoing human relationship. When banks prioritize not just what they earn on their technology, but what customers feel and do as a result, they unlock resilient growth, deeper loyalty and enduring competitive advantage.

The pivot from ROI to RoX is more than semantics—it’s a fundamental shift in how banks measure, manage and monetize digital transformation. By defining RoX, adopting rigorous measurement and embedding experience into every layer of the organization, financial services can evolve from transactional platforms into trusted digital companions—today’s imperative for thriving in the decades ahead.

The journey from buy-in to true digital excellence requires persistence. It means continually advocating for the user, iterating on feedback and sometimes challenging old ways of working. But with executive champions on your side and a clear plan in hand, your UX and design team can lead the charge in turning the bank’s digital transformation into a tangible reality—one in which customers feel the difference. As the bank’s digital brand grows stronger, so will its customer base, its efficiencies and its reputation in the market.

In closing, remind your executive team of this vision: a financial brand that’s loved by its customers because of how easy and rewarding it is to deal with at every digital touchpoint. That love translates to loyalty, market share and financial success. This is the ROI of UX and digital branding. By following the guide and taking action, your bank can join the ranks of those that have turned user experience into their biggest strategic asset. Now, the next step is yours: start the conversation, back it with data, and watch as insight turns into action, and action into transformation.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin