What is digital transformation in banking and how could UX design help?

Digital transformation in banking and financial services is the complete digital technology integration into all processes of a financial institution, changing the basics of company operation and the customers they serve.

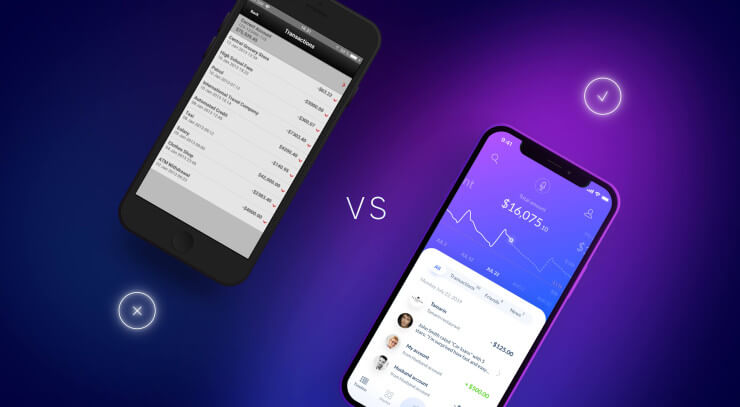

Digital transformation in banking requires not only adapting new financial technologies, but primarily establishing a cultural switch to ensure a user centered approach in creating digital banking solutions that delight users.

The following are some different digital transformation types:

- Digital transformation in retail banking

- Digital transformation in commercial banking

- Digital transformation in investment banking

All of these have a similar roadmap and provide digital transformation risks in banking. If you ignore customers’ expectations and needs for digital banking services, this could decrease demand and ruin transformation. A successful digital banking transformation strategy must be user centered, refocusing the entire organization on delivering maximum value to its customers, thus winning their loyalty and support.

Check out the best articles by UXDA about digital transformation in banking.

Banking on Purpose: How We Are Creating Tomorrow's Financial Brands

Some call it authenticity, essential benefit, value proposition, or uniqueness. We use the concept of a "soul" to describe the unique character or essence of the financial product and how it impacts its users.

How to Find and Hire the Best Fintech Design Agency

Discover how to choose the right fintech designers for your financial company's digital product and secure a digital advantage in the highly competitive financial industry in 2023.

UXDA's Experience Pyramid: Effective Banking App Design

To make digital financial products demanded, effective banking app design should be based on three complementary approaches.

Financial Services In The Metaverse: The Glue For A Creative Economy

The metaverse will become the next global milestone after the digital transformation in the next few decades.

Fintech App Design Guide: 20 Simple Tips to Fixing Common Financial App Issues

Is it possible to improve the customer experience of a financial app in just a few days? Check out our guide with 20 examples that demonstrate how you can skyrocket the user experience of mobile banking solutions using the power of financial UX design.

What The Banking World Can Learn From The TERRA Tragedy

The sudden crash of the Terra coins Luna and UST has proven to be a very painful lesson for the financial world. People need trustworthy financial services that are stable and won't make people lose their entire life savings in 24 hours.

Bank Culture: Transforming Banking Strategy with the UX Matrix

Companies with disruptor culture have the greatest potential. These businesses maximize their chances of success with Value and Design. These elements affect the formation of customer experience within any business. How finance companies can use this knowledge to establish disruptive culture?

Why Non-Purpose-Driven Banks Are Losing Customers

How can purpose-driven banking save banks from losing millions? The main challenge is how to align banking services and products with a human-centered purpose.

Financial Services Design: Building Reputation for the Experience Economy

What is the most valuable thing in any company that can be built and developed over 20 years, but can be destroyed in five minutes? It is brand reputation.

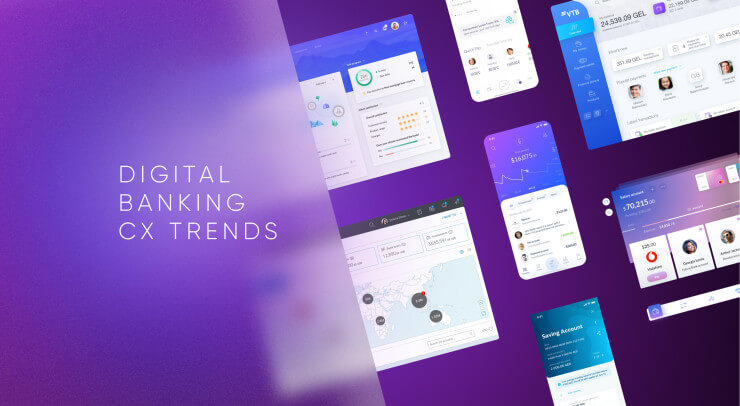

Digital Banking Customer Experience Trends for the Breakthrough

What is needed to achieve a breakthrough in the post-pandemic world? Here are 10 digital banking customer experience trends to find the right strategy.

Banking Customer Experience Gap: Blindspots That Ruin Digital Banking

How would you react if your FI spent half a million and 2 years on developing a new app but after launching it, the customer satisfaction decreased? There are 7 non-obvious factors that can either lead you to a digital breakthrough OR completely sabotage it.