Imagine awakening in a dystopian world in which everything looks the same. Every building, every car, every shop, every product—identical. People in identical suits, walking identical pets, living identical lives. The world of clones, with no choice. Would you like to live in a world like this? The world of financial brands is closer to this than you might think.

Something similar still happens in digital banking today. Good design should make a statement —but in today’s copy & paste world, it’s becoming increasingly rare.

Open ten banking apps, and you’ll feel trapped in a clone army. Similar layouts. Similar interfaces. Similar flows. The same sterile, boring digital products created by clerks without imagination and taste who fear the risks and just follow the crowd. Only colors differ at times to connect with the brand identity.

Clean, functional, predictable—yes. But also undeniably boring. Nothing that excites or inspires.

This isn't a coincidence. Banks copy one other because it feels safe, proven and market-tested. Familiar screens keep complaints down. Regulators nod in approval. Executives relax, convinced that they’ve avoided risk.

But here’s the paradox: in the Clone Wars of banking, “safe” is actually the most dangerous move. When every app feels the same, customers stop caring. Loyalty collapses into a price war: whoever offers the cheapest loan or the highest deposit rate wins. The app becomes just a commodity and not a connection.

Meanwhile, Fintechs are rewriting the playbook. They inject emotion, joy and personality into the tiniest details. A button that delights. A friendly microcopy. A design that feels alive. And suddenly, users notice. They feel the difference.

In the Clone Wars, no bank survives by blending in. The only way forward is to break the pattern—turn the app from a sterile utility into a living experience customers actually want to return to. Clone-like apps may feel safe. But in truth, they’re a shortcut to irrelevance.

Why Banks Settle for Clone-Like Generic Designs

Why are so many banks, large and small, around the world launching apps that look and work surprisingly alike? These apps favor a one-size-fits-all template-driven design that could belong to virtually any bank.

In fact, many institutions rely on white-label or off-the-shelf digital platforms that offer only superficial design customization (swap the logo and colors, and you’re done). The consequence is homogenized design patterns all around the financial industry.

Generic digital solutions turn any financial brand into a generic one, and the bank’s digital experience becomes virtually interchangeable with that of its competitors—all built on the same underlying architecture and UI patterns. In markets from Europe to North America to Asia, it’s not uncommon to find multiple banking apps that are nearly indistinguishable in layout and style.

Such minimalist banking apps typically feature basic menus, standard icons and simple form-like screens with little personality. Users might navigate through list views and generic buttons that feel more like a wireframe demo than an authentic branded experience. There is minimal use of illustrations, custom visuals, motion design or even interactive elements— nothing that truly signals a particular bank’s unique identity.

Over-reliance on these cookie-cutter designs dilute a financial brand’s unique identity, making it less memorable and harder to attract and retain digital banking customers. In other words, a bland app doesn’t just look boring—it actively undermines the bank’s ability to stand out and build customer loyalty.

Several factors have kept bank app design in a state of safe, minimalist blandness. Understanding these factors helps explain why change has been so slow in the majority of financial companies:

Legacy Infrastructure and Vendor Solutions

Many banks run on aging core systems and use third-party digital banking platforms. These platforms prioritize stability and compliance but often come with rigid front-end templates. Customizing beyond the basics can be technically difficult or even “not supported” without major redevelopment. Banks sticking to these outdated white-label front ends and legacy core systems risk clinging to a playbook rooted in the past. It’s simply easier and cheaper to launch an app with the vendor’s default UI than to invest in a bespoke design—at the cost of looking just like every other vendor’s client. This quick-to-market approach trades differentiation for convenience.

Risk Aversion and Compliance

Heavily bound by regulations, traditional banks are almost pathologically cautious about change. Being typically risk-averse, it takes them a long while to adopt new trends. Every element in a banking app is scrutinized by legal, compliance and security teams. This fosters a culture in which introducing playful new UI elements or innovative navigation feels risky—better to stick with familiar patterns that won’t confuse regulators or create unforeseen vulnerabilities. Compliance requirements also dictate certain design aspects (e.g., endless disclosures and consent checkboxes that clutter screens). The result is often a design-by-committee product that favors safety over creativity.

Organizational Silos and UX Talent Gaps

Traditionally, banks did not consider software UX a core competency. Product development might be driven by IT and business units, not UX designers. Internal teams focus on adding features or meeting security standards, rather than polishing interfaces. In fact, bank employees are usually trained in finance, risk and compliance and not in user-centered design. Many lack the specialized UX design expertise needed to craft intuitive, elegant apps. This can lead to a “copycat mentality” in design—mimicking what other banks do—because true user-driven design insight is missing. Additionally, in large banks, the people hearing customer complaints (e.g., branch staff or call centers) are separated from the digital design teams, so feedback loops are broken. All this means that UX often isn’t prioritized until there’s a major problem.

Legacy Mindset—“It Works, So Why Change It?”

Banks historically viewed their apps as utilities: a means for customers to check balances or transfer money, not a channel to delight or engage. If an app is secure and transactions go through, many executives consider it “good enough.” This mindset leads to resisting cosmetic updates or UX overhauls, especially if older customers aren’t demanding them. There’s also a fear that radical UI changes could alienate less tech-savvy users. In short, if it “ain’t broke” (from the bank’s perspective), they won’t fix it. The irony, of course, is that from the user’s perspective many of these apps are broken in terms of experience. But internally, usage numbers looked fine, so design stagnates. Only recently—with Fintech competition and a new generation of digital-first users—have banks begun to realize that stability alone isn’t enough to stay ahead in the digital era.

The dominance of generic designs is thus a byproduct of technological constraints, cautious culture and lack of design leadership—the path of least resistance. However, this path has serious drawbacks when it comes to user experience and emotional connection.

The Cost of Clone Strategy: Poor UX and Weak Emotional Engagement

Delivering a bare-bones, one-size-fits-all app might have been efficient for banks, but it has proven to be far from effective in delighting customers. A lackluster UX has tangible consequences. Common complaints about banking apps read like a checklist of avoidable design failures: unintuitive navigation, information overload and features buried in menus where users can’t find them. Many apps bombard users with jargon and lengthy forms, making even basic tasks (like setting up a transfer or updating details) feel like a chore. Financial apps are often overly complex and user-unfriendly, filled with jargon that the average user cannot easily comprehend. The outcome? Users feel confused and discouraged, sometimes doubting their own abilities when, in fact, it’s the design that’s at fault.

A generic, unoptimized UX doesn’t just slow users down—it actively frustrates them. With banking being a high-frequency activity for most people, those small frustrations add up. It’s telling that product teams at banks have resorted to publishing how-to tutorials and help videos for their apps—essentially proving the interfaces are not self-explanatory. And while users struggle through clunky flows, they form negative impressions of the brand. A clunky, characterless app isn’t just an inconvenience; it’s a signal that the institution is out of touch with customers’ expectations. In an age in which people compare every digital experience to the slickness of Big Tech and Fintech apps, a dated banking app signals a lack of innovation.

More importantly, these bare-minimum apps fail to forge any emotional connection with users. They do the job, but they don’t build or strengthen the relationship. There’s no sense of delight, surprise or personalization—nothing that makes a customer happy to use their banking app beyond the basic utility. The experience feels purely transactional. Traditional banks’ digital services feel tedious and uninspiring, lacking the emotional connection that builds loyalty and trust. When every screen consists of just data fields and monotone buttons, customers have no reason to feel any attachment or affinity; the app could belong to any bank, and they wouldn’t know the difference.

It’s unsurprising, then, that consumers (especially younger ones) readily ditch such providers for a better digital experience. In fact, 76% of consumers say they’re likely to switch banks if they find one that offers a service more suited to their needs—a sharp jump from just a few years ago. Digital-savvy users will take their deposits elsewhere if an app consistently leaves them frustrated or cold.

Personalization is another glaring missing piece. Many incumbent-bank apps don’t adapt to the user at all—everyone gets the same generic dashboard and menu, regardless of their preferences or behavior. Early banking apps took a one-size-fits-all approach, and unfortunately many have not evolved far beyond that. Only about 41% of major banks even let users customize their app dashboard (e.g., showing favorite accounts or frequent actions), although this is slowly improving in recent years, according to TheFinancialBrand.

Consequently, customers notice this absence of personal touch. In feedback forums, a “lack of customization options” is a common complaint—users want to tailor the app (e.g., set their own quick links, hide unused features, get relevant alerts) and are frustrated when they can’t. When an app treats every user as identical, it fails to show that the bank understands them. That’s a huge missed opportunity to build engagement through relevance.

Finally, a bland design means banks forego any chance to leverage emotional branding in their digital channel. Branding isn’t just logos; it’s the tone, style and feeling that a product conveys. A wireframe-like app conveys no feeling at all or, worse, it conveys bureaucratic dullness. Over time, this erodes the brand’s differentiation. Banking is a crowded marketplace, and if your app feels like a faceless utility, your brand starts to blur into the background. Customers may end up saying, “Well, Bank X or Bank Y; what’s the difference? Their apps do the same thing, and neither leaves an impression.” This directly undermines loyalty.

Even with considerable marketing investments, a generic user experience can undermine customer engagement and loyalty. Essentially, all the money a bank spends on ads and branding can be undone if the digital experience doesn’t live up to the promise. The cost of these poor UX decisions is thus measured in lost customer trust, attrition to Fintech competitors and an overall weaker brand in the eyes of consumers.

Here’s how clone-like apps are forced to compete with each other:

1. Features Race Without Meaningful Differentiation

Almost every app offers the same set of functions: account overview, transfers, bill payments and card management. New “additions,” like budgeting or cashback, often arrive late and feel generic. The competition then becomes a checklist game: “Do we have what others have?” rather than asking, “Do we make this feature delightful and effortless for users?”

2. Copy & Paste Layouts and Flows

Because banks benchmark one other, interfaces often look nearly identical: balance on top, quick actions below, menu at the bottom. Even user flows, like making a transfer or paying a bill, mirror one another step by step. For customers, this means switching banks rarely changes how the app feels.

3. Clone-Like = Safe and Proven

Banks view uniformity as reassuring. Similar layouts and features feel “market-tested” and “proven to work,” minimizing the risk of confusing users or failing regulatory checks. Sticking to what everyone else does signals safety and reliability—qualities banks value above experimentation.

4. Competing on Price, Not Experience

When apps are nearly indistinguishable, competition shifts to fees, interest rates and promotions. The app becomes a commodity—just a channel to access numbers—rather than a brand experience. This leaves little space to build emotional loyalty.

5. Safe Design Kills Personality

Banks avoid risks with creative design or emotional tone of voice, fearing confusion or regulatory pushback. As a result, apps lose individuality and default to neutral, sterile and predictable patterns. But this sameness makes it harder to stand out among competitors.

6. Customer Fatigue and Switching Costs

Because apps feel interchangeable, customers don’t stay for the digital experience—they stay for legacy reasons (e.g., fees, salary account, mortgages, local trust). But as Fintechs show more emotion, clarity and user joy, banks risk losing younger generations who don’t see value in “just another banking app.”

Digital banking has revolutionized convenience, speed and efficiency in financial services. Yet, in the race to deliver seamless online experiences, many banks underestimate the emotional dimension of customer experience (CX). While intuitive apps and quick transactions are important, the way customers feel during these interactions plays a pivotal role in whether they remain loyal. Forrester research shows that emotion is not just a “nice to have” in CX—it is a core driver of loyalty behaviors like continued purchasing, advocacy through recommendations, forgiveness of mistakes and deep trust. Yet only 48% of UK customers believe that their primary bank understands their unique needs and feelings.

This report examines the role of emotion in CX and why banking executives should pay close attention to emotional engagement in digital channels. It contrasts the impact of emotional CX in digital financial services with other industries, highlighting that, although all three components of CX (emotion, success and effort) influence loyalty, emotion has the largest impact. The analysis draws on recent studies (2023-2025) from leading CX research organizations (e.g., Forrester, Qualtrics XM Institute, McKinsey, Accenture, etc.) to reveal how boosting the emotional connection can translate into greater customer loyalty and business growth in banking.

Emotion-Rich UX Win Where Generic Banking Apps Fail

Apple’s Interfaces fueled by experience reveal a simple truth: how users feel when interacting with an interface matters far more than the effort it takes to design and develop it.

Take the latest Liquid Glass OS beta as an example. At first glance, the changes may seem tiny, but behind the scenes they require massive resources and demand powerful hardware. Yet the result speaks for itself: the user experience feels dramatically different compared to the flat, utilitarian interfaces found on other phones. Apple understands that design is not just about function—it’s about evoking emotion. Even something as small as the way a button animates can transform a tap into a moment of delight.

We call this Dopamine Design: crafting interfaces that don’t just work, but create a spark of joy, satisfaction and attachment. These micro-moments accumulate and result in loyalty and love for the product.

Now, contrast this with many traditional banks’ mobile apps. Open one and you might think you’re looking at a wireframe prototype rather than a polished product. Despite millions of users logging into banking apps weekly, 78% of Gen Y and 83% of Gen Z report frustration with their digital banking experience (theuxda.com). The interfaces of many traditional banks remain spartan and generic—functional, yes, but emotionally flat. A logo here, a brand color there… and little else that makes the experience feel alive, distinctive or human.

The result is a global phenomenon: banking apps that are functionally adequate yet aesthetically and emotionally underwhelming. And in this digital age when design-driven companies like Apple prove that emotion can be designed into digital touchpoints, settling for bare-minimum utility is no longer enough.

Forward-thinking financial brands—especially Fintechs and neobanks—are learning from this. By investing in emotional digital branding and superior UX, they’re turning apps from transactional tools into experiences that spark connection and trust. Just as Apple raises expectations with dopamine-triggering design details, the banks that embrace experience-rich interfaces will win the hearts and wallets of the next generation of users.

As Forrester’s CX analysts note, their benchmarks “perennially… find that emotion has a bigger —sometimes far bigger—impact on customer loyalty than effectiveness or ease.” In other words, a banking app can be fast and functional, but if it fails to make customers feel confident and valued, it may not earn their enduring loyalty. In contrast, positive emotions—such as feeling appreciated, respected or secure—can forge a stronger bond between the customer and the brand. Major CX studies in recent years reinforce this point: emotion remains a key driver of high CX performance and loyalty outcomes across industries. Banks that cultivate positive feelings (like trust, relief or appreciation) in customers stand to create more loyal relationships than those that focus only on efficiency.

It’s important to clarify that emotion in CX does not simply mean making customers happy at all costs. Often, the most impactful emotions are deeper feelings of being valued and understood. In fact, one analysis found that the top positive emotions driving loyalty were customers feeling valued, appreciated and respected.

For a digital bank, eliciting these emotions might mean designing interactions that show empathy for customer needs, respecting their time and recognizing their relationship with the bank. On the flip side, the emotions that typically drive customers away are frustration, annoyance and disappointment—often arising when expectations are thwarted (for example, when a website is unreliable or an issue isn’t resolved). This underscores that getting the basics (e.g., reliability, keeping promises) right is foundational to avoiding negative emotions, but going further to proactively generate positive feelings is what truly differentiates loyalty.

If emotion is so powerful, why do some banking executives underestimate it? There are several reasons, rooted in traditional mindsets and the nature of digital channels:

Historical Focus on Product and Efficiency

Banking has traditionally been a product-driven and risk-averse industry, emphasizing accuracy, security and efficiency. Executives often come from backgrounds in which success is measured in terms of uptime, transaction speed, interest rates and error minimization. In this mindset, customer experience improvements tend to focus on functional metrics (e.g. reducing call wait times, streamlining online forms) rather than emotional metrics. It’s easy to quantify a one-second faster login, but harder to quantify things like the customer feeling valued. As a result, emotion can be seen as a vague or secondary concern. Many digital banking initiatives prioritize the removal of pain points (which is important) but stop short of designing for positive emotional outcomes, thus underestimating the ROI of emotional engagement.

Intangible and Hard-to-Measure Qualities

Emotions are inherently subjective, making them harder to measure reliably. A bank can readily track Net Promoter Score (NPS) or task completion rates, but capturing how a customer feels requires more nuanced surveying or sentiment analysis. Because emotion doesn’t fit neatly into a KPI dashboard, executives might undervalue it or assume improving NPS/CSAT (customer satisfaction score) covers it. In truth, standard satisfaction scores often do not reveal deeper feelings. For example, a customer might rate an interaction as an 8/10 (satisfied) but still feel no strong loyalty if nothing about the experience emotionally resonated. The lack of immediate, concrete metrics for emotions means they can be overlooked in favor of what’s easily measurable. However, forward-thinking organizations are starting to use “emotion metrics” and advanced analytics (e.g., text analysis of feedback, emotion-focused survey questions) to fill this gap. Without such efforts, emotional engagement remains undervalued simply because it’s less visible.

Assumption that Digital = Impersonal

There’s a prevalent assumption that customers only want speed and convenience in digital contexts and that emotional factors mostly apply to face-to-face service. Executives may think, “If the app is working and the price is good, emotions won’t matter.” This underestimates how even digital interactions form an overall impression. In reality, customers do form emotional reactions to apps and websites —frustration at confusing interfaces, comfort from a well-designed alert or trust from seeing evidence of security. The impersonality of digital interfaces is a barrier, but not an insurmountable one. Companies in other sectors have shown that digital can be made to feel human. Unfortunately, if banking leaders believe a mobile app “can’t possibly deliver empathy,” they won’t invest in trying, which is a self-fulfilling prophecy in which digital banking stays utilitarian and misses the chance to wow customers emotionally.

Complexity of Regulation and Trust

Banks also operate under heavy regulations and a mandate of prudence. Sometimes, efforts to ensure compliance and security inadvertently lead to rigid, unfriendly customer experiences: think of a blunt fraud warning or a declined transaction with no explanation, leaving the user anxious or frustrated. The necessary focus on trust in terms of security can overshadow the equally important trust that organically comes from empathy and openness. Ironically, trust has an emotional foundation: customers grant trust when they feel the bank is dependable and on their side. Forrester’s research in Europe revealed that lack of empathy is a key reason customers do not fully trust their banks. Many banks underestimate this link— they assume trust can be won solely through reliability and competence, not realizing that emotional proof points (like showing understanding during a crisis) are what complete the trust equation. Thus, by underestimating emotion, banks may also be undercutting their ability to strengthen customer trust.

Short-Term Pressure vs. Long-Term Loyalty

In a competitive and cost-conscious environment, banking leaders may prioritize initiatives that show immediate results (e.g., automating a process to save money or launching a new feature to attract users). Building emotional engagement can be seen as a longer-term play, whose benefits (e.g., loyalty, advocacy) accrue over time. If KPIs and incentives are aligned only to quarterly results or acquisition numbers, there’s less internal push to invest in the qualitative aspects of CX that build loyalty over years. This can lead to a cycle in which emotional elements are labeled “soft” or nice to have, rather than as strategic investments in customer lifetime value. Only churn rising or the NPS stalling might emotionally get attention—and by then, catching up can be difficult. Savvy executives are breaking this cycle by recognizing that emotional loyalty is a long-term asset that warrants investment before it shows up as a pain point.

In summary, emotional engagement is often underestimated in digital banking because it lives outside the traditional comfort zone of metrics and ROI calculations. Banks pride themselves on trustworthiness and efficiency, sometimes to the detriment of warmth and personal connection. However, this is changing as evidence mounts about the outsized impact of emotion. The industry is beginning to acknowledge that feelings of trust, care and value are not squishy extras, but fundamental ingredients to keep customers from drifting to competitors. The next section explores how banking executives can leverage this insight.

In summary, emotional engagement is often underestimated in digital banking because it lives outside the traditional comfort zone of metrics and ROI calculations. Banks pride themselves on trustworthiness and efficiency, sometimes to the detriment of warmth and personal connection. However, this is changing as evidence mounts about the outsized impact of emotion. The industry is beginning to acknowledge that feelings of trust, care and value are not squishy extras, but fundamental ingredients to keep customers from drifting to competitors. The next section explores how banking executives can leverage this insight.

How Emotion Drives Key Loyalty Behaviors

How do digital financial services compare to other industries when it comes to emotional engagement? In many ways, the importance of emotion is universal—whether customers are shopping for groceries or managing their finances, their loyalty is heavily influenced by how the experience makes them feel. But the degree to which companies deliver on emotional needs varies by industry, and this is where digital banking often faces challenges.

Compared to other industries, banks and Fintech platforms face a trust-sensitive environment. Money matters are inherently emotional for customers (involving security, stress, aspirations, etc.), yet digital finance interfaces can feel cold or impersonal. This contrast signals both a challenge and an opportunity.

The challenge is that banks must work harder than, say, an entertainment company to convey positive emotions through a screen, because the financial subject matter can trigger anxiety or caution. The opportunity is that any bank that does manage to deliver empathy, personalization and emotional reassurance in digital banking can differentiate itself strongly. Many tech-savvy consumers haven’t come to expect warmth from an app, so when a bank surprises them with a compassionate message during a hardship, or a personalized insight that makes them feel understood, it stands out, thereby increasing loyalty and retention.

In fact, emotional engagement may be the next frontier of competitive advantage in digital banking. Modern banks have excelled at digital innovation but “lack emotional connection,” and now personalization is key to rebuilding loyalty in this fragmented digital landscape. Forward-looking banks are already experimenting with ways to humanize digital banking, for example, by using AI to provide empathetic virtual assistants, or by proactively reaching out to customers with personalized financial health tips that show genuine concern.

Notably, other industries provide education that digital banking can adopt. Industries such as retail and hospitality have long known that experience (e.g., ambience, personal greetings, special perks) drives repeat business as much as the product itself. E-commerce players blend ease with emotional tactics like loyalty rewards and community building. Fintech and banking can and must adopt similar approaches (e.g., celebratory messages when customers reach savings milestones or thoughtful gestures like fee waivers in hardship) to spark positive feelings and increase loyalty.

The key takeaway is that emotionally engaging CX is a differentiator across industries, and right now many digital financial services have room to grow in this area. Banks that only focus on being the fastest or cheapest may find themselves matched by many competitors. Banks that also forge emotional loyalty will cultivate customers who stick with them even when others offer enticing promotions.

Emotion in CX has a direct, measurable impact on whether customers exhibit loyal behaviors. Four specific behaviors are commonly used to gauge loyalty in banking and other industries: purchasing more, recommending to others, forgiving mistakes and trusting the provider with one’s business. Recent research confirms that excelling in the emotional dimension of CX significantly boosts all four of these behaviors:

Increased Purchasing

Customers who feel a strong positive emotional connection with a financial brand are far more likely to deepen their relationship by buying additional products and services. According to a Qualtrics cross-industry study, consumers with a “high emotion” CX rating were 4.6× more likely to purchase more from an organization compared to those who had a poor emotional experience. This means that if a banking app not only functions well but makes users feel confident and taken care of, those users are much likelier to open new accounts, invest in new products or expand their dealings with the bank.

Advocacy and Recommendations

Emotionally satisfied customers often turn into brand advocates. The same study found these customers were 8.8× more likely to recommend the company to friends and family. In banking terms, a delighted digital banking customer might actively promote the bank’s app or services to others. This is crucial as personal recommendations and positive word-of-mouth are powerful drivers of growth in financial services. It aligns with the notion that when people feel genuinely cared for by their bank, they want others to experience it, too.

Forgiveness of Mistakes

No service is perfect—even top banks encounter occasional glitches or errors. The question is how forgiving customers will be when things go wrong. Emotion plays a decisive role here. Customers who have formed an emotional bond are 6.7× more likely to forgive a company for a mistake. For instance, if an online banking outage occurs, customers who generally feel valued and trust the bank are more inclined to be more patient and give the bank another chance. They believe the bank has their best interest at heart, whereas emotionally disengaged customers might quickly lose patience and switch after a single stumble.

Trust and Long-Term Loyalty

Trust is both an outcome of positive experiences and a driver of future loyalty. High-emotion experiences massively boost customer trust: consumers with a strong emotional experience were 5.1× more likely to trust the organization. Trust in banking is paramount: it underpins whether customers feel comfortable keeping their money with the institution or sharing personal data. When digital banking services communicate transparently and respond with empathy, they build trust capital. Forrester research in the UK shows that empathy is the most important lever of trust for UK banks. UK customers want accountability, but only 48% of customers believe that their primary bank understands their unique needs and feelings.

These findings make it clear that emotion-fueled CX is a catalyst for loyalty behaviors. A purely functional digital banking experience might get the job done, but it may not inspire a customer to enthusiastically endorse the bank or stick around if a competitor offers a slightly better rate. In contrast, a bank that consistently makes customers feel secure, heard and valued can expect those customers to buy more, stay longer and sing the bank’s praises to others.

This has direct financial implications. As McKinsey notes, delivering not just satisfaction but delight and positive surprise in customer interactions “has the power to amplify retention, referrals and revenue” beyond the baseline of a merely satisfied customer. Both the rational and emotional aspects of customer experience must be addressed.

Emotional engagement, therefore, is not a fuzzy concept—it translates into quantifiable business outcomes. Banking executives should view positive customer emotions as a strategic asset that drives purchase frequency, lowers churn, increases NPS and CSR and insulates the customer relationship from the impact of occasional problems.

Fintechs and Neobanks: Winning with Emotional Digital Branding

In stark contrast to the incumbents, Fintech startups and neobanks have set a new bar by making their apps engaging, personalized and emotionally resonant. These digital-native providers recognized early that a banking app can be more than an utility—it can be an experience that users actually enjoy.

Free from legacy constraints and risk-averse cultures, Fintechs have been quick to adopt modern UX practices and even invent some new ones in finance. Virtually all the recent UX innovation in banking has come from these challengers. So what are Fintechs and neobanks doing differently in design?

For one, they infuse strong brand personality into their apps. Fintech apps don’t look like wireframes; they look like the brand’s identity made digital. Bold colors, unique illustrations, friendly fonts and even mascots or characters are not uncommon. The overall visual style is carefully crafted to be memorable. A Fintech that switches financial services from functional tools to authentic brand experiences makes you feel something about the company’s vibe—whether it’s playful, empowering or ultra-modern—whereas a generic bank app feels emotionally empty.

Fintechs also excel at humanizing the tone and interaction. Some incorporate emojis, humor or encouragement right into the UI to build a friendly rapport. Even little design flourishes turn the app from a sterile ledger into something more akin to a personal finance coach. The generous use of color and whitespace also makes Fintech UIs feel more open and less intimidating than the text-dense screens of old-school apps. The net effect is that users feel more comfortable and engaged, and managing money feels less of a chore and more of a personalized experience.

Another hallmark of Fintech UX is gamification and rewards woven into the app. Neobanks have famously introduced features like spending challenges, savings goals with progress trackers and instant gratification for positive actions. This ties into what we at UXDA call “Dopamine Banking”—leveraging the brain’s reward mechanisms to make finance engaging.

For example, UK-based Monzo sends users friendly notifications celebrating each time they hit a savings milestone, complete with festive animations. Some apps give badges or perks for good financial habits (like maintaining an emergency fund). This approach transforms banking from a static utility into an interactive game of personal finance in which users feel a sense of achievement. It’s a powerful shift toward users beginning to enjoy engaging with their digital money and, by extension, with the financial brand behind the app.

Most importantly, Fintechs and neobanks design with the user’s emotions in mind at every step. Their apps aim to reduce anxiety and build trust through innovative design. That can mean a smoother onboarding flow, contextual help messages that anticipate confusion or visually highlighting the most important information to avoid overload. Fintechs obsess over removing pain points that traditional apps have simply tolerated. When they add advanced features, they ensure it doesn’t create a cognitive burden.

A great example is how some leading apps like Chime, SoFi, Revolut or Cashapp handle complex tasks with simple, guided flows and visual cues, making it feel easy. These companies also aren’t afraid to inject delight—from quirky loading screen art to confetti effects on a paid-off loan. As UX experts advise, tapping into positive emotions through design (e.g., color, animation, micro-interactions, illustrations, bright colors) can make the product more fun and enjoyable, thereby skyrocketing user engagement. Neobanks understood that in a world of infinite app choices, experience is as much a selling point as functionality.

All of this has given Fintech brands a distinct advantage: user loyalty and word-of-mouth enthusiasm that traditional banks struggle to attain. People rave about an app like Chime or Nubank not just because of cheaper fees, but because “it just makes managing my money feel easier and even enjoyable.” These apps build a kind of emotional equity. Customers who feel genuinely cared for, and even charmed, by their banking app are far less likely to churn.

They develop trust through daily positive digital interactions, something a sterile app fails to do. It’s no wonder that banks clinging to bland design see their younger customers shifting to Fintech alternatives that feel modern and customer-centric. A superior digital experience isn’t just nice to have; it’s a competitive necessity to stand out in a clone-like range of apps to win hearts and wallets.

Emotional Digital Experience as a Strategic Edge

Facing stiff competition and commoditized services, banks have to find out how investing in emotional branding and top-notch UX could become a strategic differentiator in a crowded market, not just about pleasing users. When interest rates, card rewards and branch locations all start to look the same, the digital experience becomes a key way to stand apart. A well-designed, emotionally engaging app can make a mid-tier bank compete like a cutting-edge innovator. Conversely, a bland app can drag even a big-name bank reputation down, creating a perception that its brand experience is behind the times.

The strategic benefits of prioritizing UX and emotional connection are backed by data. Customers today reward the brands that deliver great digital experiences. A Saleforce study shows that 59% of customers consider “cutting-edge digital experiences” essential to maintaining loyalty to a brand. They won’t stick around if an app consistently disappoints. In fact, as mentioned, a majority are open to switching banks for a better fit—and “better fit” increasingly means easier, modern and more personalized digital service.

A financial brand that leads in app UX can steal market share even if it’s smaller or younger, simply by attracting the dissatisfied users of larger rivals. We’ve seen this play out with the rise of digital-only banks such as Nubank or Revolut, gaining millions of customers with very little physical presence. Their only app is their bank, and when done right, that’s enough to lure people in. Traditional banks can fight back by upping their UX game, turning what was once a weakness into a strength.

Emotionally engaging digital service design drives greater usage and cross-sell opportunities. When users enjoy an app, they log in more often, explore more features and develop trust in new services offered. For example, a customer who loves the budgeting tool in their banking app is more likely to consider that bank’s loan or investment products, and the positive experience spills over into openness toward the brand’s offerings.

On the flip side, a bank that fails to modernize its app might not only lose customers, but also see lower product uptake from remaining customers, because they just use the app for bare essentials and nothing more. In contrast, an app that feels like a helpful financial companion can become a platform for growth—customers stick around and do more business through that channel.

Another angle is brand differentiation. Banks spend billions on marketing trying to distinguish their brand image. But if the app experience doesn’t match the advertised promise, the brand messaging falls flat. Conversely, a distinctive app is marketing in itself. It reinforces whatever unique value or personality the bank claims to have.

For instance, if a bank’s brand mantra is “we put customers first,” a thoughtfully designed app will make users feel that—through intuitive flows, accessible support and proactive personal touches. All of this serves to strengthen the brand’s credibility. There’s also a network effect: people talk about apps they love. A standout banking app will generate positive reviews and social media buzz in a way that no amount of traditional advertising can achieve. Especially among younger consumers, a slick app is basically the price of entry to be considered a modern brand.

Finally, embracing emotional UX and design thinking encourages an internal culture of innovation. Once a bank commits to differentiating on experience, it has to listen to users, iterate quickly and break down silos—all healthy, future-proofing moves for the organization. It’s notable that banks leading in digital experience (like U.S. Bank, which consistently ranks high in app ratings) have made UX and design integral to their strategy, not just an afterthought.

Leading banks experiment with features like AI-driven personalization and integrated financial wellness coaching, which serve to further enhance engagement. This creates a virtuous cycle: a culture of innovation leads to better apps, which leads to happier customers, which reinforces the bank’s competitiveness, attracting even more innovative partners and talent to the bank. On the contrary, banks that remain stuck with “the way it’s always been” face mounting hidden costs—from brand erosion to talent attrition—as the industry evolves around them.

By implementing emotional UX strategies, banks can turn the abstract concept of emotional engagement into concrete practices that drive loyalty. It’s about institutionalizing empathy: building it into digital design, employee training, metrics and the company culture. Notably, technology can be an enabler here: modern CRM systems, AI chatbots and analytics can help personalize scale interactions and detect customer emotions in real time.

For example, AI-driven insights can flag if a usually active customer has reduced activity (potentially indicating dissatisfaction) so that the bank can reach out proactively with concern, mimicking the intuition of a caring local branch manager. Such approaches bring back a personal touch that was common in traditional banking but tailored for the digital age. Ultimately, the banks that succeed will be those that marry high tech with high emotion, delivering digital solutions with a human heart.

Understanding the power of emotion is the first step; the next is acting on it. Banking executives can harness emotional engagement as a strategic tool to deepen customer loyalty in the digital era. Here are few ways to do so:

1. Embed Empathy and Personalization in Digital Interactions

Every digital touchpoint is an opportunity to show the customer they are understood and valued. Rather than a one-size-fits-all solution, banks should use data wisely to personalize experiences. This could mean greeting customers by name, providing insights tailored to their financial situation or proactively offering help based on detected needs. When a banking app or website responds as if it “knows” the customer, it creates a feeling of being valued rather than just being an account number.

Accenture’s 2025 consumer study finds that 73% of consumers engage with multiple banks beyond their main bank, and 58% purchased a financial service or product from a new provider in the last 12 months. Accenture emphasizes that banks that make customers feel valued and understood build long-lasting relationships and convert customers into advocates.

Even simple personalization (like acknowledging a customer’s tenure or customizing content to their goals) can humanize a digital experience. Additionally, an empathetic tone in digital content matters—for example, error messages or fraud alerts can be written with a reassuring tone (“We noticed something unusual, and we’re here to help keep your account safe”) rather than just a cold alert. Modern AI and analytics enable this at scale, allowing digital channels to approximate the personal touch of a friendly banker who knows the customer’s story.

2. Leverage Omnichannel “Hybrid” Experiences

Rather than forcing customers into purely digital self-service at all times, leading banks offer seamless transitions to human support when appropriate. This strategy acknowledges that certain moments have high emotional stakes, such as resolving a fraud incident, discussing a loan during hardships or planning for retirement, whereas speaking with a human can build trust and relief.

By blending digital efficiency with human empathy (the “phygital” approach), banks can achieve both ease and emotional resonance. Forrester’s UK banking analysis explicitly urges brands to weave hybrid experiences into customer journeys to create empathy and impact, since emotion has the highest impact on loyalty. Concretely, this might mean integrating quick ways within the app to contact a representative (with context transfer so the customer doesn’t have to re-explain their issue), or scheduling a video chat for complex inquiries. When customers know they can reach a caring human when needed, their overall confidence in the digital service increases.

Even digital-only banks can simulate a human touch through high-quality customer service: AI-powered chats, quick outreach if an issue arises and proactive check-ins. The key is not to treat digital and human channels as silos, but as complementary parts of one emotional journey. Training customer support teams in empathy and empowering them to solve problems is crucial, because one empathetic interaction can turn a lukewarm customer into a loyal fan who feels the bank “has my back.”

3. Design for Positive Emotional Outcomes

Banks should incorporate emotional criteria into CX design alongside functional criteria. When rolling out a new app feature or customer process, bankers should ask: How do we want our customers to feel during this experience? For example, a budgeting tool might be designed to make users feel in control and optimistic about their finances. A mortgage application flow might aim for reassurance and trust.

By explicitly defining target emotions (e.g., confident, cared-for, appreciated), designers and product managers can craft the user interface, messaging and support elements to evoke those feelings. This could involve adding reassuring language, celebrating milestones (like congratulating a user on achieving a savings goal) or providing gentle guidance in moments of potential confusion. Additionally, consider adding elements of delight, those small surprises that can spark joy.

McKinsey research notes that even in cost-conscious times, delighting customers with unexpected touches (within reason) can amplify loyalty and advocacy. In digital banking, a delight might be as simple as a personalized thank-you note for a long-time customer or waiving a fee as a courtesy—gestures that show the bank cares, not just transacts. The goal is to move from transactions that are merely hassle-free to interactions that are memorable and positive.

4. Measure and Act on Emotional Feedback

To manage something, you must measure it. Banks should extend their voice-of-customer programs to explicitly capture emotional feedback. This might involve adding questions to surveys like, “Did you feel cared about in this interaction?” or using sentiment analysis on customer comments/chats to gauge emotional tone.

Analytical tools can track customers’ emotions over time (e.g., via an “emotional index” similar to what CX consultancies use). By monitoring these signals, executives can identify where emotional gaps exist —perhaps customers feel anxious during onboarding or undervalued in communications about fees. With that insight, targeted improvements can be made (e.g., rewriting a confusing policy notification that was unintentionally causing frustration). Importantly, closing the loop with customers shows empathy in action: if a user expresses dissatisfaction or worry, responding personally and addressing their concerns can turn the situation around.

Remember that responding with empathy is in itself a loyalty driver; customers appreciate when their feelings are heard. As a Forrester study highlighted, companies that show they value, appreciate and respect customer feedback and time (e.g., not making them repeat information or visibly fixing issues raised) reinforce those very emotions and earn more loyalty. Executives should champion a culture in which customer emotions are taken as seriously as data, and success is defined not just by solving problems but by how customers feel about the solutions.

5. Rethink Loyalty Programs and Communications through an Emotional Lens

Many banks have loyalty programs or marketing communications that focus on financial incentives (e.g., points, discounts, rates). While these are rational benefits, there is an opportunity to infuse emotional rewards as well. For example, recognition is deeply emotional: highlighting and thanking customers for their loyalty publicly or personally can make them feel proud and appreciated. Some banks send anniversary notes (“Happy 5th year with us!”), which, though simple, tap into emotional psychology.

Likewise, crafting communications that speak to customers’ life events (sending congratulations on a new house or empathy during regional hardships) show that the bank sees the customer as a person. Such gestures build an emotional rapport that pure transactions cannot. According to industry research, consumers are far more loyal to companies that demonstrate authentic empathy, especially in tough times.

In practice, this might involve empowering frontline staff or relationship managers to make small goodwill gestures when warranted (a bonus interest bump or a fee reversal with a kind note). These gestures can pay back through increased customer goodwill. Banking executives can audit their customer touchpoints to remove any unintentionally negative emotional cues (e.g., jargon-laden letters, intimidating fine print) and replace them with clarity and warmth, all while staying compliant and professional. The result is a brand voice and experience that consistently conveys, “We care about you and your financial well-being.”

Breaking the Clone Cycle: Brand Differentiation at Every Level of the Experience

In a world in which every banking app looks like a clone, true differentiation begins not with surface aesthetics, but with the depth of experience. To stand out, a financial brand must climb all five levels of the UXDA Value Pyramid—from the functional foundation to the emotional peak. Each level provides a different kind of value that together transforms a product from a sterile tool into a living, breathing digital experience.

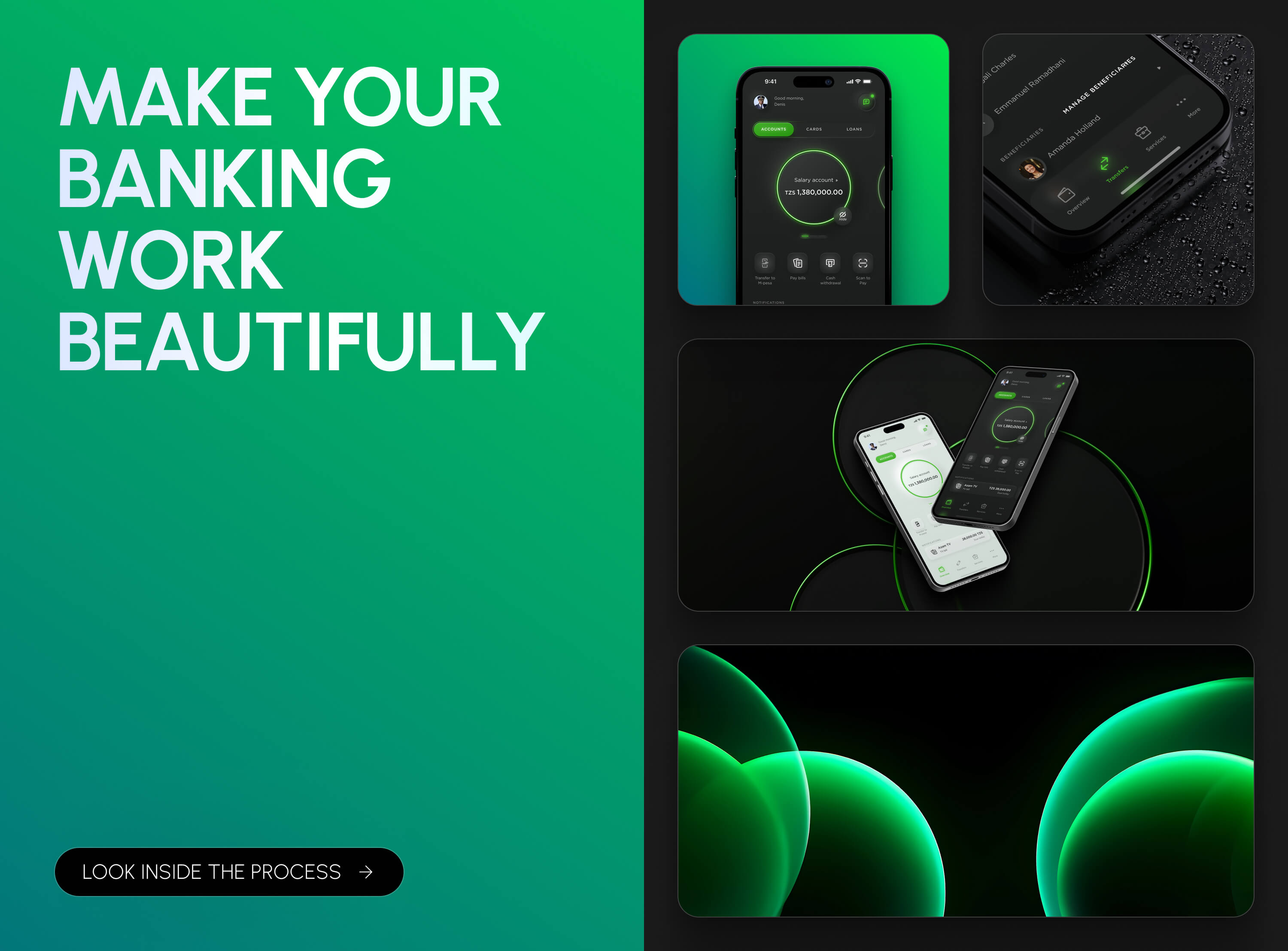

1. Functional Value—Make It Work Beautifully

Reliability isn’t just a nice-to-have” in finance; it’s the baseline of trust. If the app stutters, stalls or goes down, users won’t give your brand a second chance. “It just works” must be engineered—before, during and after launch. That means setting hard go-live criteria, proving capacity under real-world load and running a gradual rollout with instant rollback options. Long load times, lags, missing status feedback and downtime aren’t cosmetic issues in banking; they’re trust killers. A strong launch and runtime posture ties product, engineering, SRE, support and comms into one playbook so users experience consistent speed, stability and clarity from day one.

Bring this to life by:

- Defining performance budgets and service-level objectives (SLOs). Set target app starts, screen renders and interaction latencies. Define uptime/error budgets and enforce them pre-launch. Validate with synthetic + real-user monitoring, include complete quality assurance (QA) and UX testing.

- Ensuring pre-launch load and failure testing. Run peak-load, soak and chaos tests that mirror paydays, campaign spikes and release traffic. Ship only when go-live criteria are met.

- Ensuring safe releases by using feature flags, canary/blue-green deployments and a documented rollback plan; roll out to cohorts before full traffic.

- Planning observability and response by centralizing logs/metrics/traces; define on-call, incident comms and RTO/RPO. Publish clear in-app status and recovery guidance during issues.

- Enabling support readiness by training support on new flows, known issues and macros before launch. Close the loop with telemetry-driven hotfixes, and monitor reviews in the App Store.

- Connecting UX and development by ensuring that the UX design team works closely with the development team.

2. Usability Value—Make It Effortless

Functionality ensures capability; usability ensures clarity. Clone apps copy layouts without understanding how people think. Differentiation happens when usability is empathetic—when the app “thinks” like its user. Do your interactions follow the user’s mental model, or force them to adapt to yours?

Bring this to life by:

- Practicing behavioral research (e.g., task analysis, think-aloud, diary studies) to align apps IA and flows with real mental models.

- Applying progressive disclosure and cognitive load limits (e.g., chunking, defaults, smart prefill) so complex tasks feel simple.

- Using plain-language and emotion-aware microcopy; replace jargon with terms customers use and understand.

- Designing contextual shortcuts (e.g., recent payees, frequent actions, intent-based search) to compress repeat tasks to a tap.

- Defining a Recovery UX (e.g., predictive validation, inline fixes, guardrails) that prevents errors before they happen.

- Baking in accessibility and zero-dead-end error-handling with supportive microcopy that reduces anxiety.

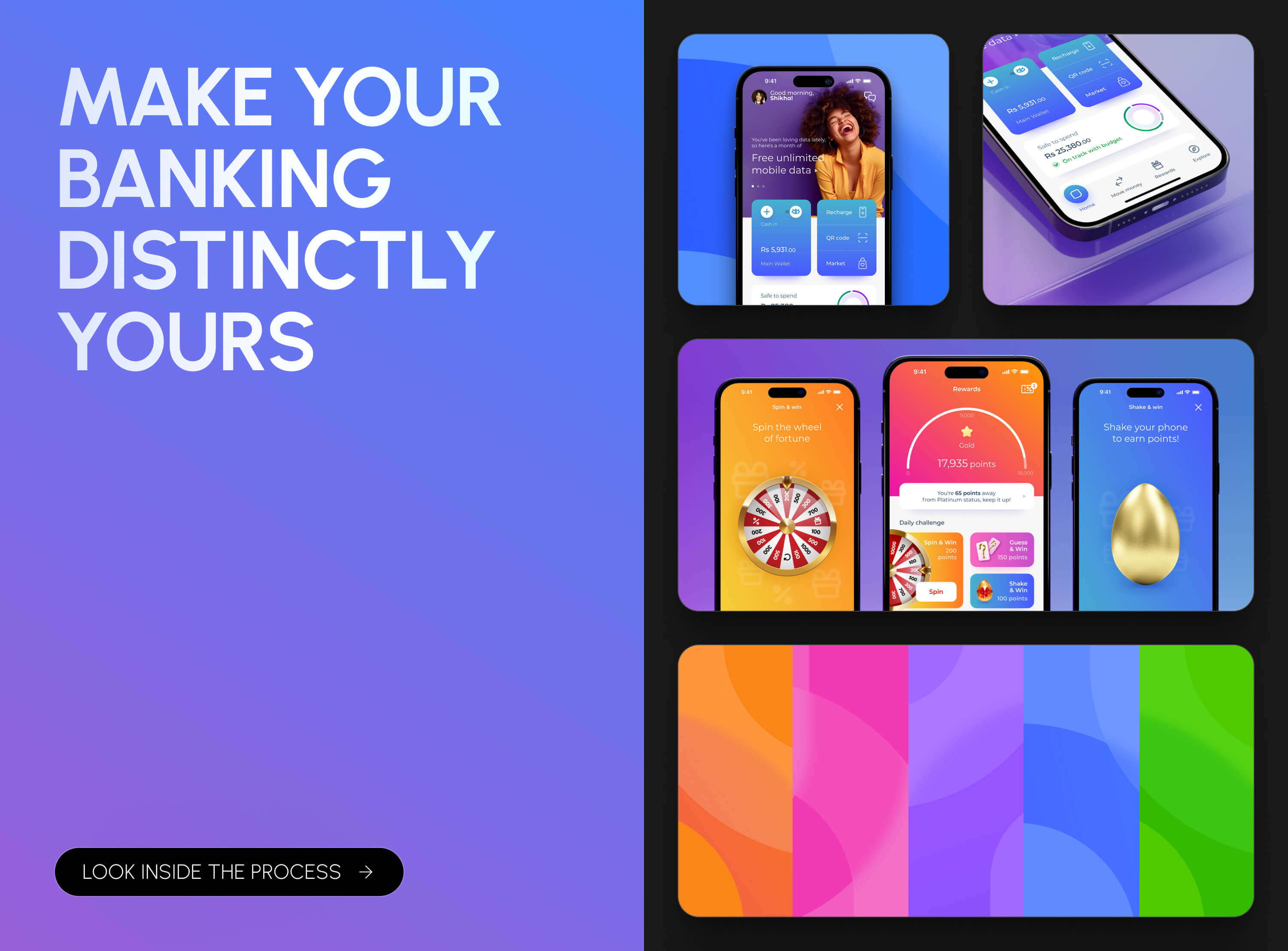

3. Aesthetic Value—Make It Distinctly Yours

Aesthetics aren’t just a decoration; they’re the language of your brand’s soul. Unique, consistent visuals and motion communicate identity before a word is read. Can users recognize your app with one glance without even seeing the logo?

Bring this to life by:

- Translating Digital Experience Branding into a consistent design system (e.g., tokens, type, color, shape, grammar, motion principles) that encodes brand personality into your digital ecosystem.

- Using signature micro-interactions to create memorable “brand moves” that users feel.

- Establishing motion ethics: purposeful, fast, meaningful animations that signal cause→effect and reduce uncertainty.

- Creating a visual narrative (e.g., illustration style, icon semantics) that’s inclusive, human friendly, brand-driven and instantly identifiable.

- Enforce accessible contrast and responsive density so beauty never fights readability or speed.

- Ensure emotional connection with users through the Dopamine Banking approach.

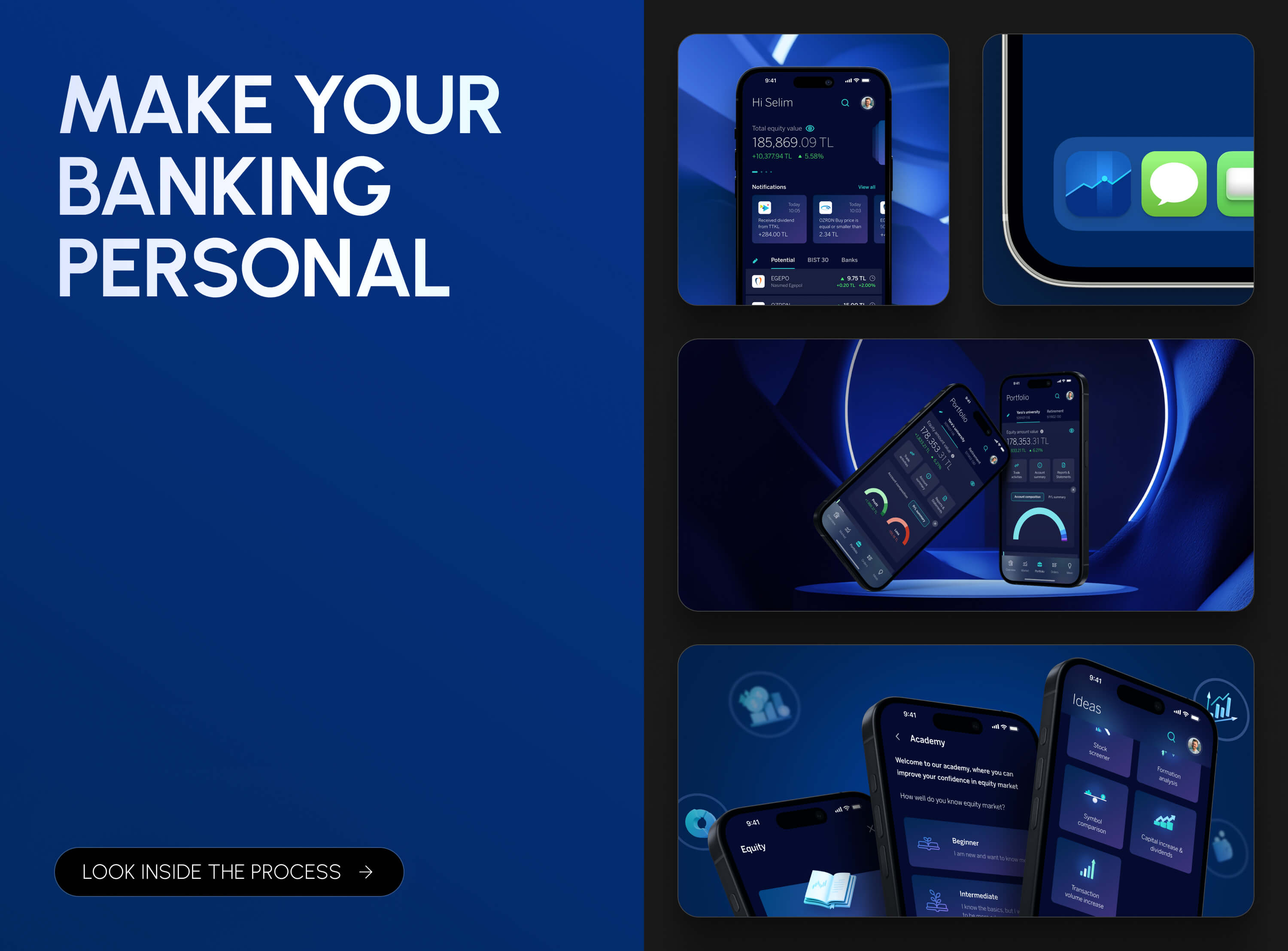

4. Status Value—Make It Personal (Lifestyle Alignment)

Personalization isn’t a dashboard rearrangement; it’s designing the banking experience around the customer’s lifestyle, moments and aspirations. Think beyond transactions: curate contexts (e.g., travel, family, studies, side hustle, wellness), adapt content and actions to intent, and blend financial tasks with everyday opportunities. Lifestyle-driven design reframes the app from a ledger into a companion that aligns with customer status and even knows what matters now, showing up with the right value at the right time.

Bring this to life by:

- Turning lifestyle segmentation into customer journeys by mapping segments to life-event and day-in-the-life journeys (e.g., moving, travel, first investment, family milestones). Orchestrate financial tasks, tips and offers accordingly.

- Implementing adaptive surfaces by using intent detection to dynamically surface the next best action, location-aware perks and timely utilities into a dedicated lifestyle area, not buried in menus.

- Practicing goal-centric storytelling by turning numbers into momentum—progress rings, streaks and milestone moments that celebrate healthy habits (such as ethical Dopamine Banking).

- Ensuring omnichannel continuity by letting users start in-app, pick up on web or chat and hand off to a human with full context for high-stakes moments.

- Provide family and community modes by supporting shared goals, junior accounts and value-aligned perks that connect money with everyday life and relationships.

- Ensure the lifestyle layer reflects your Digital Experience Branding—tone, visuals, motion and rituals consistent with purpose and values.

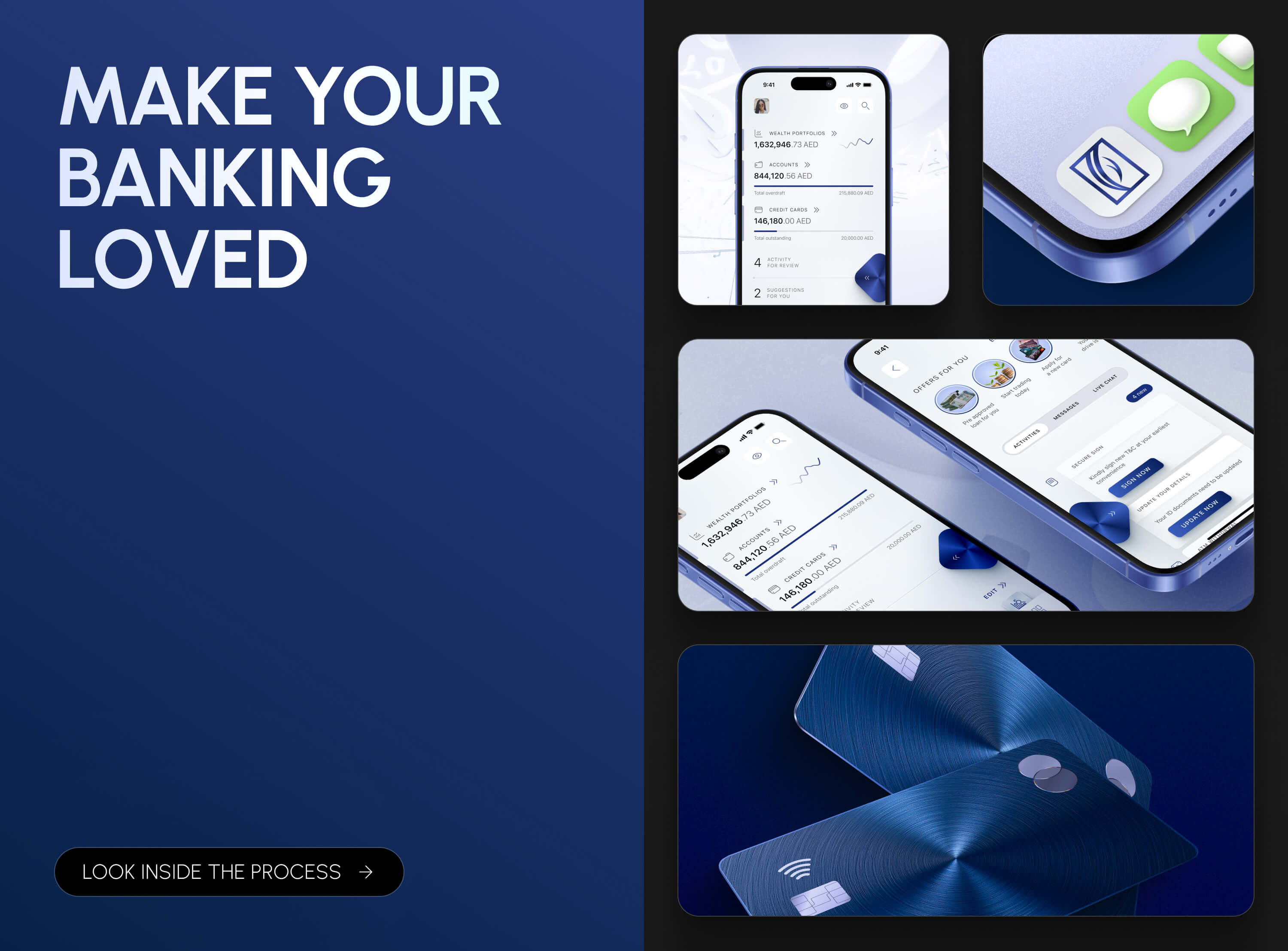

5. Mission Value—Make It Loved

Mission value is the true differentiator that no competitor can copy. This is where users fall in love with the brand experience because it reflects their identity and values. It’s the realm of Dopamine Banking—where positive emotion, delight and purpose turn daily banking into a rewarding experience.

Crucially, the digital product must embody and activate the brand’s purpose, company values and mission. When the interface, tone and behaviors consistently express what the brand stands for, it attracts a community of like-minded customers who share those beliefs. These customers don’t just use the product; they belong to it. Over time, they become brand advocates, fueling word-of-mouth and defending the brand through trust built on shared purpose.

Would customers miss your app if it disappeared tomorrow and proudly recommend it because it reflects their values as much as it serves their needs?

Bring this to life by:

- Embedding brand purpose, values and mission into product behaviors (e.g., fair, transparent defaults; supportive language in stressful moments; celebratory rituals around good financial habits).

- Designing community touchpoints that amplify shared values (e.g., stories, milestones, impact dashboards, cause-aligned rewards).

- Closing the loop between mission and features so customers can see and feel the brand promise in everyday interactions.

- Creating rituals and ceremonies (e.g., value-aligned milestones, gratitude moments, year-in-review) that strengthen their sense of belonging.

- Using surprise and delight thoughtfully (e.g., personal notes, fee waivers at tough times) to convert mere satisfaction into affection.

- Measure emotion explicitly (e.g., confidence, relief, pride) and close the loop with empathetic follow-ups that prove you listen.

Conclusion: Is your financial brand a commodity or a community?

The era of sterile, wireframe-like banking apps is ending. If your digital experience looks and feels interchangeable, you’re choosing a commodity—competing on price, features and short-term promos. Users don’t want that. They crave intuitive, personalized, emotionally engaging interactions—even when the stakes are as serious as money.

Digital leaders have already shown that banking can be a true experience: sparking joy, building trust and gaining loyalty while staying secure and compliant. By shedding risk-induced design inertia, incumbents can evolve from functional portals into vibrant extensions of their brand identity. This isn’t about flashy graphics; it’s about genuine connection—interfaces that make people feel understood, respected and valued. Do that, and indifferent account holders become enthusiastic advocates. That’s community.

Prioritize UX and emotional branding as core pillars of competitive strategy. Invest in design talent. Listen deeply to users. Break the mold of “boring but safe.” In a world in which every bank is a tap away, the winners craft experiences that feel less like a wireframe and more like a warm handshake—or even a high-five. The tools exist; what’s needed is vision and courage. An emotional digital experience isn’t “soft.” It’s a hard advantage that drives growth and loyalty—one of the smartest investments in today’s Fintech era.

Customers may arrive for convenience or rates, but they stay because of how you make them feel. Across industries—and especially in finance—emotions like being understood, secure and appreciated correlate most strongly with loyalty. Functional excellence is the baseline; emotion propels loyalty to the next level. Ignore this, and your service becomes one more interchangeable clone. Embrace it, and you cultivate customers who forgive more, trust more, buy more and recommend you more.

Make emotion and uniqueness intentional in your CX strategy. Treat journeys not only as processes to optimize but as experiences to enrich. Learn from best practices, measure what matters (including feelings), empower teams to deliver empathy even through digital channels and hold yourself accountable for emotional outcomes. The payoff: higher retention, greater share of wallet, stronger word of mouth and resilience when markets turn.

The power of emotion in digital banking has been underestimated—but forward-thinking leaders are changing that. Champion emotional engagement, and your institution transforms from a commodity people use into a community people choose. That unlocks behaviors no amount of pure efficiency can buy: customers who not only stay but grow with you and advocate for you. Amid constant disruption, that depth of loyalty may be the most valuable currency of all.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to build a strong competitive advantage through strategic UX and digital experience systems, talk to UXDA. We empower financial organizations to scale experience systems that align business strategy, digital products, and customer needs — enabling sustainable growth, clear differentiation, and long-term customer value through emotionally intelligent digital experiences.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin