What is the future of banking and how does it depend on UX design?

This is a hypothetical question. To define the future of banking, we need to analyze the current trends in the financial industry. There are multiple and dramatic speculations on what awaits the banking sector in the next decade, but, from a customer’s perspective the only answer to "Is digital banking the future?" is "Yes.", because it is clear for everyone that our future will be digital, cashless and personalized.

Instead of asking "Why digital banking is the future?" we have to admit that the future of banking technology is already here, and we can see more and more disruptive solutions from Fintechs. Open banking topples the monopoly of banks and gives Fintechs access to customer data across the whole industry. This will generate a huge amount of Big Data that will be utilized by highly skilled financial AI designers. Such future artificial intelligence in banking will deliver personalized solutions, offers and suggestions to customers helping to manage their finances on a new level.

There is no separate future of business or community banking, or even a future of transaction banking, because the future of banking in general will rely heavily on the digital experience provided to its customers. This will result in huge competition, global delivery and thousands of customized digital initiatives in banking. We are looking at a world of endless opportunities due to disruptive banking technology, a tough digital world ruled by customers.

Check out the best UXDA articles about the future of banking.

Digital Banking ROI: How Strategic Product Design Increases Bank Profits

As the financial industry evolves, digital products will remain central to a bank's identity and perception, making digital product design and UX key elements of banking strategy, brand identity, and profitability.

Decision-Making Under Pressure: What Banking UX Can Learn from NASA

How prepared are traditional banking players? Despite all their experience, resources, confidence, and influence, could they still fail their customers, leaving them stranded in the 'digital' space like NASA astronauts? The standoff between Boeing and SpaceX in space suggests this is entirely possible, but there is a solution.

On-Device vs Cloud AI and the Future of Personalized Banking UX

Integrating AI into banking services will obviously revolutionize the user experience in financial services, offering real-time advice and 24/7 transaction monitoring. The main question is which AI will serve banking first ─ on-device AI or cloud-based AI? Let’s compare!

AI as a Humanizing Force in Financial Brand Marketing

There is another promising area of AI use for financial brands ─ marketing and brand communication. The UXDA team assessed the potential of humanizing financial brands using ChatGPT and Midjourney by creating digital mascots based on the mobile service interface.

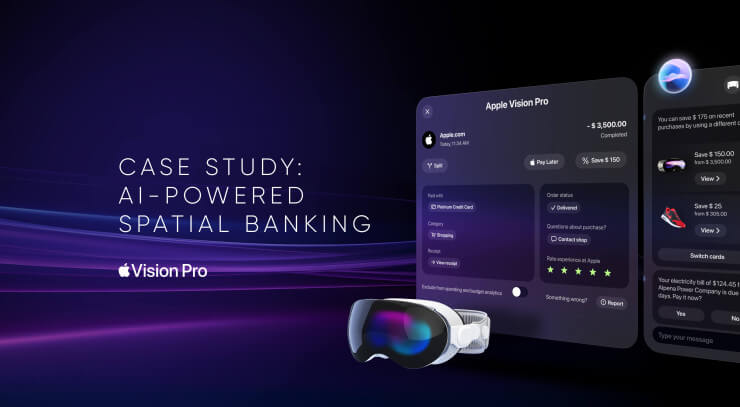

UX Case Study: Implementing AI to Shape the Future of Spatial Banking

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

Future Banking Trends: Enable Next-Gen Financial UX

Future Banking Trends include technologies such as Generative AI, the metaverse, the blockchain, embedded banking, DeFi with CBDCs, and open banking which are creating the next-gen financial UX.

From Outdated to Outstanding: 10 Experience Redesigns in Fintech and Banking

Today's consumers seek seamless, intuitive and emotionally resonant interactions with their financial institutions. We offer ten examples of how financial products can be transformed to exceed expectations and create an emotional connection through a stunning UX design by UXDA.

From Design Sprints to UX Marathons in Banking Transformation

Building a digital service is a must, but it is not enough to provide financial services to digital customers. It has to match the customers' expectations to strengthen the brand for the future. To ensure this, financial companies must perceive the digital service as a product, not a channel.

UXDA's AI Banking Design Wins A'Design Award Gold in Italy

UXDA received the Gold Award for the AI conversational banking app UX/UI design in the most prestigious and renowned Italian design competition A’ Design Award.

CBDC Banking Could Disrupt Banks and “Steal” Their Funds

The Central Bank Digital Currencies (CBDCs) could start a new age in banking by impacting the financial customer experience and, as a result, disrupting the traditional business model. Will this CBDC trend be a threat or bailout for the industry, and how can UX design help banks to prepare for it?

Here's Why Open Banking is the Future of Fintech Experience

Total digitalization has brought changes to the financial industry and the open banking revolution will make UX design crucial in the future.